Recently, Jinyuan Hydrogen Energy has passed the hearing of listing on the Hong Kong Stock Exchange, or will become the third listed hydrogen energy company in China. The company mainly produces hydrogenated phenyl chemicals and energy products, and similar to the early development trend of other hydrogen energy enterprises, Jinyuan Hydrogen Energy has also fallen into the situation of "declining performance". According to the prospectus, the company's revenue and gross profit continued to rise in the past three years, but in the first half of this year, Jinyuan Hydrogen Energy realized revenue of 1.076 billion yuan, a slight decline from 1.079 billion yuan in the first half of 2022. In the same period, the company's net profit was 65.714 million yuan, down 43.85% year-on-year, while the net profit in the first half of the year also showed a significant decline, to 65.71 million yuan, down 37% year-on-year.

Under the background of the country's vigorous promotion of "double carbon" development, hydrogen energy ushered in a small climbing period in this winter. On

December 8, Henan Jinyuan Hydrogen Energy Technology Co., Ltd. Henan Jinma Energy Co., Ltd. (hereinafter referred to as "Jinma Energy") is still the holding company of Jinyuan Hydrogen Energy, which will become the third hydrogen energy listed company in China after Yihuatong and Guohong Hydrogen Energy, and the first case of coal enterprises splitting hydrogen energy subsidiaries listed in China. Split up and go public for the rest of your life

after

"dismantling"! On August 28 this year, Jinma Energy intends to split the shares of its wholly-owned subsidiary Henan Jinyuan Hydrogen Energy Technology Co., Ltd. into independent listings on the main board of the Hong Kong Stock Exchange through a global offering. After the spin-off and listing, Jinyuan Hydrogen Energy is still its holding subsidiary.

Jinma Energy was established in February 2021, and in October of the following year, Shanghai Hydrogen Maple transferred its 20% stake in Jinma Hydrogen Energy to Jinma Energy. Since then, Jinma Hydrogen Energy has become a wholly-owned subsidiary of Jinma Energy.

As a supplier of hydrogenated phenyl chemicals and energy products in Henan Province, Jinyuan Hydrogen Energy was founded in 2012, and its predecessor was Henan Jinyuan Hydrogen Energy Technology Co., Ltd. The company mainly focuses on the production and processing of hydrogenated phenyl chemicals (mainly including pure benzene, toluene and xylene), energy products (including liquefied natural gas, gas and hydrogen), hydrogenated phenyl chemicals (mainly including pure benzene, toluene and xylene). This can also be seen

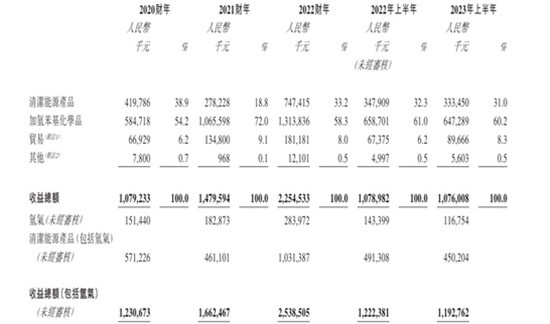

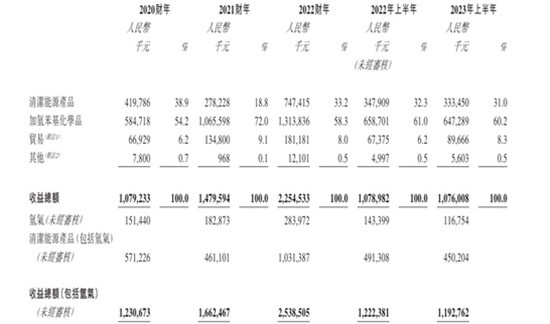

from the company's financial report, from 2020 to the first half of 2023, hydrogenated phenyl chemicals accounted for more than half of the total revenue, ranging from 54.2% to 72%.

Source: Prospectus

According to Frost & Sullivan, in terms of revenue in 2022,

Jinyuan Hydrogen Energy is the largest pure benzene supplier in Henan Province, with a market share of 18.6%, and the market size of pure benzene in Henan Province accounts for 3.4% of China's market share.

Jinyuan Hydrogen Energy is the third largest LNG supplier in Henan Province, with a market share of 4.9%, and the market share of LNG in Henan Province is 1.8% in China. In July

2023, while Jiyuan Jinyuan Chemical Co., Ltd. was restructured into a joint-stock company, the company's name was also changed to "Henan Jinyuan Hydrogen Energy Technology Co., Ltd." One month before the submission of the form, Jinyuan Hydrogen Energy "changed its name on the fire line", and the coat of hydrogen energy was put on. Before

splitting Jinyuan Hydrogen Energy, it also aimed at the A-share market. In September 2020, Jinma Energy's guidance securities firm filed with Henan Securities Regulatory Bureau for guidance and planned to launch an A-share IPO. However, a year later, the Henan Securities Regulatory Bureau received a statement on its guidance on the termination of listing.

However, similar to the early development trend of many hydrogen energy enterprises, Jinyuan Hydrogen Energy has also fallen into the situation of "declining performance".

However, similar to the early development trend of many hydrogen energy enterprises, Jinyuan Hydrogen Energy has also fallen into the situation of "declining performance".

According to the prospectus, the company's revenue and gross profit continued to rise in the past three years, but the gross profit and revenue in the first half of this year showed a significant decline, the gross profit in the first half of this year was 110 million yuan, down 5.4% from the same period last year.

In the first half of the year, Jinyuan Hydrogen Energy realized revenue of 1.076 billion yuan, down slightly from 1.079 billion yuan in the first half of 2022. In the same period, the company's net profit was 65.714 million yuan, down 43.85% year-on-year, while the net profit in the first half of the year also showed a significant decline, to 65.71 million yuan, down 37% year-on-year.

Source: Prospectus & nbsp; & nbsp;

Hydrogen business revenue is on the rise. From 2020 to 2022, the hydrogen sales revenue of Jinyuan Hydrogen Energy grew rapidly, with a compound annual growth rate of 37%. At present, the annual production capacity of Jinyuan Hydrogen Energy Gas is about 560 million cubic meters, of which the hydrogen content is about 230 million cubic meters.

According to the prospectus, Jinyuan Hydrogen Energy mainly involves the production and sale of hydrogen for fuel cells and the construction of hydrogenation stations in the field of hydrogen energy, with a hydrogen business revenue of 116 million yuan in the first half of 2023.

According to the cooperation agreement signed between Jinyuan Hydrogen Energy and the local government, Jinyuan Hydrogen Energy will build 15 hydrogenation stations in the next three to five years .

However, the huge initial investment of hydrogenation stations and the lack of self-supply of hydrogen have become the existence of unstable profit growth after listing.

It is reported that Jinma Hydrogen Energy currently relies mainly on Jinjiang Refining and Chemical Joint Venture Company

for hydrogen production . Jinyuan Hydrogen Energy currently has 24 million cubic meters of hydrogen production capacity and purification equipment. At present, the annual production capacity of high-purity hydrogen for fuel cells is 48 million cubic meters. Its raw materials are supplied by pipeline transportation. In order to ensure the demand for hydrogen, Jinyuan Hydrogen Energy has also entered into a tripartite framework agreement with Henan Yida Min'an Municipal Service Co., Ltd. and Yutong Commercial Vehicle Co., Ltd. Pursuant to the agreement, Yida Min'an will purchase no more than 1,000 fuel cell muck trucks manufactured by Yutong, and Jinyuan Hydrogen will operate a gas station equipped with hydrogenation facilities at an agreed price for the muck trucks purchased by Yida Min'an.

(Original title: Jinyuan Hydrogen Energy: "Immediate Success" or "Remaining Life After Demolition")

However, similar to the early development trend of many hydrogen energy enterprises, Jinyuan Hydrogen Energy has also fallen into the situation of "declining performance".

However, similar to the early development trend of many hydrogen energy enterprises, Jinyuan Hydrogen Energy has also fallen into the situation of "declining performance".

浙公网安备33010802003254号

浙公网安备33010802003254号