Photovoltaic film industry is facing pressure, the third quarter performance rebounded, but the fourth quarter is affected by the low price of film and high inventory of components, the performance is expected to be unsatisfactory. Film competition pattern is relatively stable, leading Foster market share is about 50-60%, and the industry concentration is relatively high. With the increasing penetration of N-type components, enterprises need to have diversified and high-quality adhesive films to meet customer needs.

Photovoltaic film is similar to photovoltaic glass, although the third quarter shipment meets a small climax, but due to the double drag of lower film prices and high inventory of components, the fourth quarter performance is difficult to achieve.

With the continuous improvement of N-type component penetration, only diversified and high-quality film enterprises can meet customer needs and not be eliminated.

Q4 film market is hardly optimistic

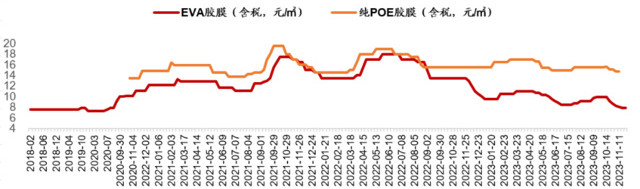

. Entering the fourth quarter, that according to the latest price of SMM photovoltaic film on November 16, EVA film has dropped to 7.88 yuan/square meter;"; EPE film fell to 9.9 yuan/square meter; pure POE film fell to 14.

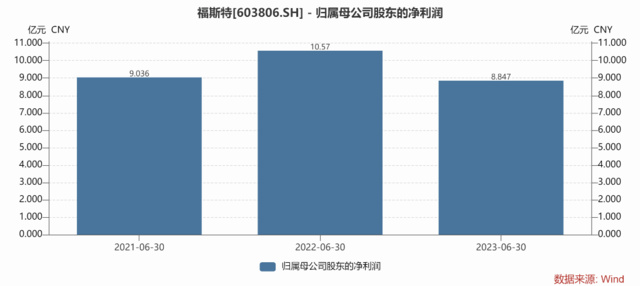

This year, the photovoltaic film industry fluctuated greatly, and the days were difficult from the second quarter. In the second quarter, the price of silicon materials entered the downward channel, and it was difficult to see the bottom. The wait-and-see mood of downstream components was strong, and the purchase of film was not active. From April to July, the price of film continued to decline. In early April, the price of EVA film was 11 yuan/square meter, and in early July, it had fallen to 8. Therefore, in the first half of this year, whether it was Foster, Saiwu Technology or other enterprises, the performance was ugly. The net profit of Foster 2023H1 was 884 million yuan, down 16.31% year on year; The performance of Saiwu Technology in the first half of the year was even worse, with revenue falling by 1.66% year-on-year and net profit attributable to parent company falling by 71.

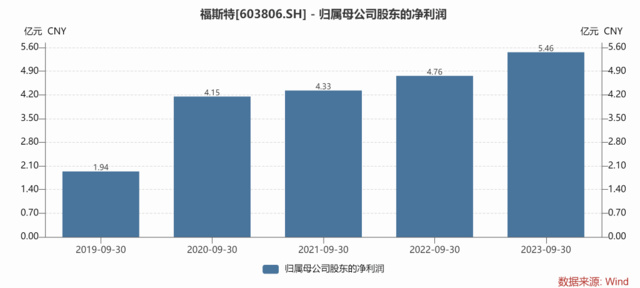

Foster's revenue in the first three quarters was 16.65 billion yuan, up 23% year-on-year; Net profit attributable to the parent company was 1.43 billion yuan, a year-on-year decrease of 6. Q3 revenue was 6.034 billion yuan, an increase of 33.2% year-on-year, and net profit attributable to the parent company was 546 million yuan, an increase of 14.

Foster also said that the company shipped 1.595 billion square meters of photovoltaic film in the first three quarters, an increase of 77% year-on-year; Among them, Q3 shipped 6. However, the profit was slightly under pressure because in July, August and September, the price of film products was low in July, which led to profit pressure. The profit was repaired in August-September, which corresponded to the price increase of film in August-September. The market share of

Foster photovoltaic film is over 50%, which is in the absolute leading position of photovoltaic film, and its performance can basically reflect the overall situation of photovoltaic film industry. Similar

to photovoltaic glass, the fourth quarter performance of film is also under pressure. Jianzhi Research has mentioned in the article "Photovoltaic Glass Q4 Encountered" Difficulties "| Jianzhi Research" that photovoltaic glass Q4 is also under pressure, on the one hand, because of the rising cost of natural gas, on the other hand, because of the fierce price war of downstream components, the peak season is not prosperous, mainly to the warehouse, so it is difficult for Q4 photovoltaic glass performance to surpass Q3. Photovoltaic film also has similar logic, the worst performance of photovoltaic film is the second quarter, the third quarter is a small climax of performance, but the fourth quarter profit pressure is still high. In terms of

price, at the end of September, the price of EVA particles and EVA film dropped rapidly, from 16200 yuan/ton to 14780 yuan/ton, down 8%, because the price of components is close to 1 yuan/W, once the price of EVA particles is lowered, component enterprises naturally hope that the price of film enterprises will be reduced. At the end of October, the price of EVA particles dropped again to 12555 yuan/ton, and the film continued to fall.

However, because the particle inventory cycle is about one month, the film after the price reduction in November is matched with the particle price in October, which will lead to greater profit pressure in November. In addition, POE is also adjusting its price, so it is still under great pressure to make up for the loss of EVA through the profit of POE film. In terms of

quantity, the inventory of components in the fourth quarter is high, and from the end of the year to the Spring Festival next year, it is mainly to go to the warehouse, and the willingness to purchase large quantities of film is weak, so it is difficult to increase the shipment volume substantially. So on the whole, Q4 photovoltaic film enterprises also have to struggle to survive.

Film competition pattern is relatively stable, leading advantage is obvious

, compared with photovoltaic glass, film business model is relatively good. Because photovoltaic film belongs to the industry with light assets but heavy operation. Moreover, there are not many new entrants to the cross-border photovoltaic film market, and the competition pattern is relatively stable, mainly dominated by Foster, which accounts for about 50-60% of the market, and the industry concentration is relatively high.

The film is mainly divided into three types: EVA film, EPE film and POE film. With the iteration of photovoltaic cell technology, the requirements of packaging materials for modules are higher and more diversified. This year, the penetration rate of N-type components in the market is gradually increasing, especially the N-type components mainly based on TOPCon. With the increase of N-type components, the demand for film is more diversified. At present, the film market presents a situation of coexistence of a variety of packaging schemes.

For example, TOPCon is the coexistence of a variety of packaging solutions, a small number of component companies are using the dual POE film solution, dual POE is the most reliable solution, but the cost is high. Double EPE film solutions are also used, such as JA Technology and JinkoSolar; EPE + EVA solutions are also used, such as Atlas and Trina Solar; POE + EVA solutions are also used, such as JinkoSolar. Only for TOPCon components, different enterprises choose different films.

However, after the price of components dropped to around 1 yuan/W, because the price was too low, the pure POE scheme was reduced and replaced by EPE film. Although POE has the best stability and good effect, POE particles are in short supply, and China mainly relies on imports, so under the background of price war in the industrial chain. Have to temporarily choose the lower cost of EPE film packaging.

Component factories will not use two film enterprises for packaging at the same time, so if an enterprise can only produce one kind of film, it will be difficult to meet the diverse needs of customers, and it will be difficult to accept new orders, and eventually it will inevitably lose part of the market share and be eliminated by the market.

For outsiders, if they want to meet the production of a variety of films at the same time, and pass the quality control, they need higher time cost, technology cost and capital cost, and under the background of uncertain profits, the performance-price ratio of entering the film industry is not high, so the overall pattern of the industry is relatively stable, and the market share of leading Foster is also rising. Moreover, Foster's POE film with high gross profit accounts for about 40% of the total, and its profit structure is better.

Although the leading advantages of photovoltaic film are obvious, but similar to other links, under the background of domestic overcapacity, Foster is also frequently looking for opportunities to go to sea, trying to expand overseas share. At the end of October, the company also said that it decided to raise funds to carry out "Thailand's annual production 2. With the construction projects in Vietnam and Thailand, the company's overseas film production capacity will be increased to 600 million." Global competitiveness has been enhanced.

Overall, as a photovoltaic auxiliary material, whether it is film or photovoltaic glass, in fact, the fourth quarter performance pressure is affected by the high inventory of components, but the film cycle attributes and the difficulty of starting and stopping are weaker than photovoltaic glass, so the two are still quite different.

Photovoltaic glass assets are heavier, while film assets are lighter, which tests the competitiveness of enterprises in different categories. At present, the pattern of photovoltaic film industry is not as bad as the market imagines. The concentration of leading Foster is still increasing, but the short-term performance is still under pressure. In the long run, the probability is still the pattern of the strong.

浙公网安备33010802003254号

浙公网安备33010802003254号