By the end of October 2023, about 911 hydrogen energy-related policies had been issued nationwide, including 155 at the national level, 335 at the provincial level and 421 at other levels. In terms of the number of relevant hydrogen energy policies issued by various provinces and municipalities, the five major fuel cell vehicle demonstration city clusters, the key areas of hydrogen entering ten thousand cities, and Sichuan and Inner Mongolia, which have outstanding resource endowments in the hydrogen energy industry chain, are the main force in the introduction of hydrogen energy policies. From the development goals of provincial fuel cell vehicles and hydrogenation stations, the cumulative planning goals of fuel cell vehicles in each province far exceed the national planning. There has always been a chicken-and-egg contradiction between

fuel cell vehicles and hydrogen refueling stations: the density of hydrogen refueling stations is not enough to stimulate the willingness of manufacturers and consumers to buy cars, and the lack of hydrogen vehicle sales will make it difficult for hydrogen refueling stations to operate and expand. To solve this contradiction, the top-level design and planning of the government is indispensable.

In recent years, the state and local governments have actively promulgated hydrogen energy industry planning, set the development goals of fuel cell vehicles and hydrogen stations, and promoted the development of fuel cell industry. What is the gap between reality and planning at this stage?

According to the statistics of the hydrogen energy database of the Orange Club, by the end of October 2023, about 911 hydrogen energy related policies had been issued nationwide, including 155 at the national level, 335 at the provincial level and 421 at other levels. Of the 31 provinces, autonomous regions and municipalities directly under the Central Government (excluding Hong Kong, Macao and Taiwan), only Hainan, Heilongjiang, Yunnan and Xizang have not issued provincial hydrogen and fuel cell vehicle industry plans, while the other 27 provinces and municipalities have all issued provincial hydrogen industry plans.

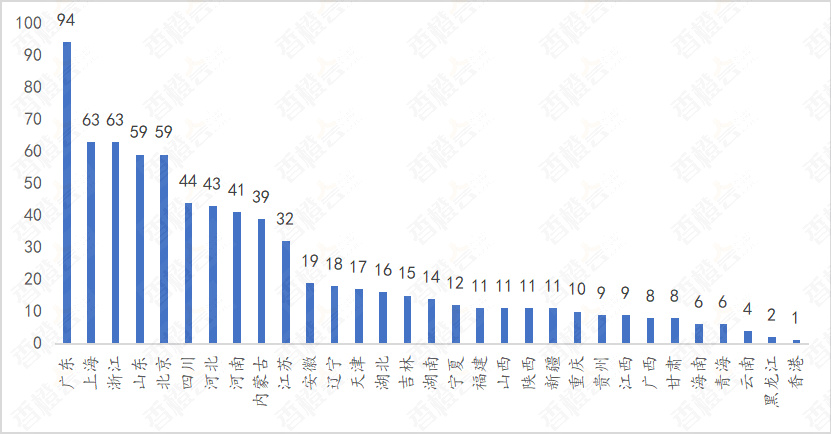

According to the number of relevant hydrogen energy policies issued by various provinces and municipalities, the five major fuel cell vehicle demonstration city clusters, the key areas of hydrogen entering ten thousand cities, and Sichuan and Inner Mongolia, which have outstanding resource endowment advantages in the hydrogen energy industry chain, are the main forces of hydrogen energy policies. Guangdong Province ranks first in the number of policies issued, with about 94. Shanghai, Zhejiang, Shandong and Beijing are not far behind, with about 60 policies issued; Hebei, Sichuan, Henan and Inner Mongolia are about 40.

Figure 1: The introduction of hydrogen energy policies by provinces across the country Data source: Orange Research Institute

Provincial fuel cell vehicle and hydrogen station development targets

According to the provincial planning issued by 27 provinces, the cumulative fuel cell vehicle planning targets of each province far exceed the national planning. Except for Gansu and Xinjiang, which did not mention the development target of fuel cell vehicles and hydrogen stations, most provinces have planned the promotion target of fuel cell vehicles and the construction target of hydrogen stations in 2025, and a few provinces such as Beijing, Shandong and Shanxi have planned the development targets of 2023, 2030 and 2035. In 2025, the total number of fuel cell vehicles planned to be promoted in each province is about 116900, far exceeding the national target of about 50000 fuel cell vehicles in 2025; A total of 1148 hydrogenation stations are planned to be built in each province, which is basically consistent with the construction target of at least 1000 hydrogenation stations planned by 2025 in the Roadmap of Energy Conservation and New Energy Vehicle Technology 2.0. The planned number of hydrogen vehicles in

8 places has exceeded 10,000. The planned number of fuel cell vehicles in Beijing, Shanghai, Guangdong, Hebei, Shandong, Shanxi, Shaanxi and Jiangsu in 2025 is about 10,000, followed by 6,000 in Sichuan, 5,000 in Henan, Zhejiang and Inner Mongolia. The planned number of hydrogen stations

in Guangdong is far ahead. In 2025, the maximum number of hydrogen stations planned to be built in Guangdong is 200; the second is 100 in Hebei, Shandong and Shaanxi, and the third is 80 in Henan.

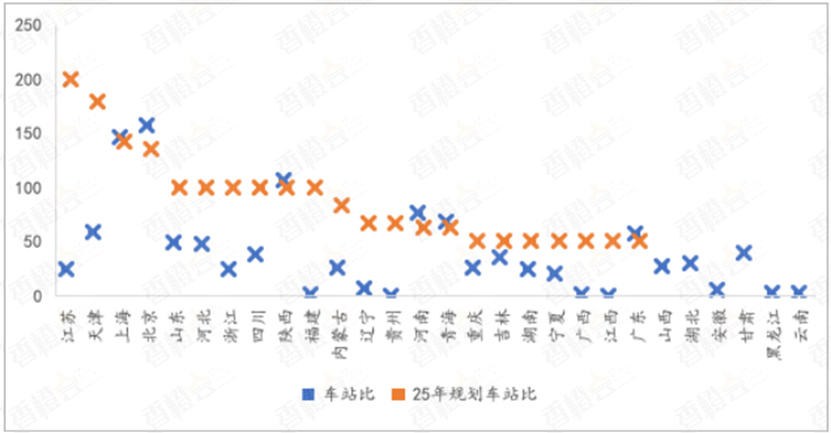

The planned station ratio is developed towards a larger proportion. In 2025, the accumulative planned ratio of hydrogen vehicle to hydrogen station in each province is 102:1; the highest ratio of planned hydrogen vehicle to hydrogen station in Jiangsu is about 200:1; the ratio of planned hydrogen vehicle to hydrogen station in Shanghai and Beijing is about 140:1; the ratio of planned hydrogen vehicle to hydrogen station in Hebei, Shandong, Shaanxi, Sichuan, Zhejiang and Fujian is about 100:1.

Table 1: Planned Quantity of Provincial Fuel Cell Vehicles and Hydrogen Refueling Stations in China & nbsp;

Data Source: Sorted

by Orange Club Research Institute & nbsp; Development Status of

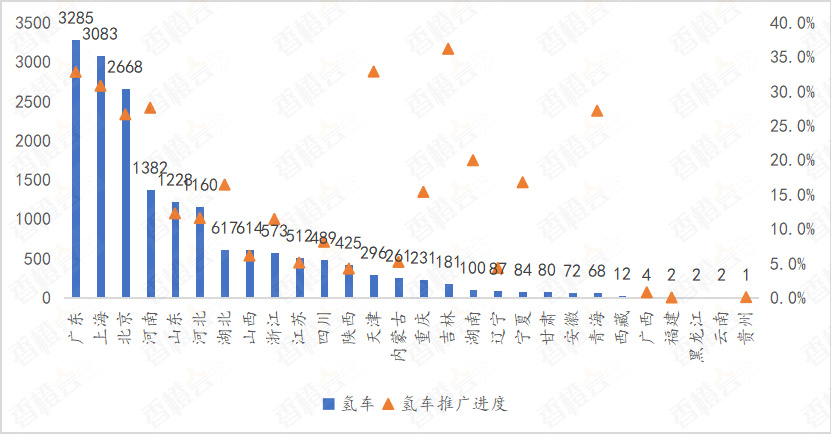

Provincial Fuel Cell Vehicles and Hydrogen Refueling Stations The sales of fuel cell vehicles are mostly in Guangdong, Shanghai and Beijing. According to the statistics of vehicle insurance, as of September 2023, the sales volume of fuel cell vehicles in China is 17736. From the regional distribution, the sales volume of fuel cell vehicles in Guangdong is 3285, the second is 3083 in Shanghai, the third is 2668 in Beijing, the second is 1382 in Henan and 1228 in Shandong. In the non-fuel cell demonstration city group, Hubei has strong research strength in hydrogen energy, relying on the mature traditional automobile industry chain to develop the hydrogen energy industry chain, and the sales volume of fuel cell vehicles reached 617; Shanxi is rich in hydrogen sources, and the demand for heavy freight, urban logistics, park commuting and other transportation applications is broad, and the sales volume of fuel cell vehicles reached 614. With the expected expansion of the third batch of demonstration urban agglomerations, the competition in Hubei, Shanxi, Zhejiang, Sichuan and Chongqing has become more and more intense.

Figure 2: Sales volume of fuel cell vehicles in each province and city in China and the completion degree of the 2025 target Data source: Xiangcheng Research Institute

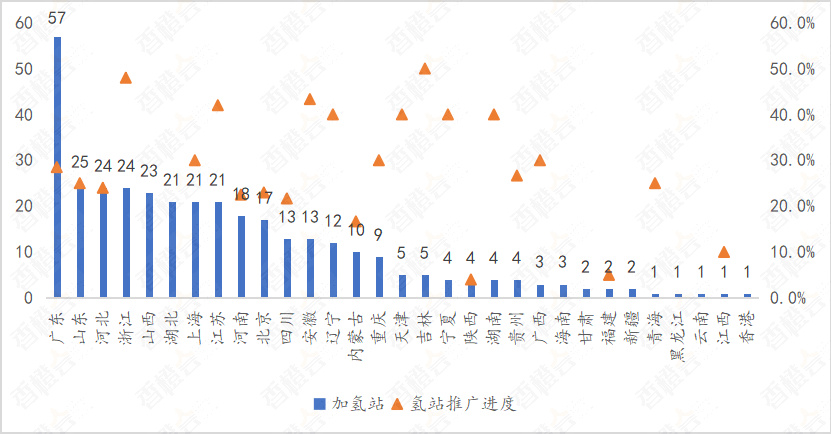

Only Xizang of the provincial administrative units have not built hydrogen stations, and the rest of the regions have built hydrogen stations. As of September 2023, China has built 351 hydrogen stations, of which Guangdong has built 57, ranking first, obviously ahead of other provinces; Shandong, Hebei, Zhejiang, Shanxi, Hubei, Jiangsu and Shanghai are in the second echelon, with 20-30 hydrogen stations built; Henan, Beijing, Anhui, Sichuan, Liaoning and Inner Mongolia belong to the third echelon, and more than 10 hydrogenation stations have been built.

Figure 3: Number of Hydrogen Refueling Stations Built in Each Province of China and Completion Degree of 2025 Target Data Source: Orange Club Research Institute

& nbsp; & nbsp; According to the completion of provincial planning targets in 2025, the promotion of hydrogen vehicles and hydrogen stations needs to be accelerated. As of September 2023, the number of fuel cell vehicles in China (17736 vehicles) accounts for 35.5% of the national planned number (50,000 vehicles) in 25 years and 15.2% of the cumulative planned number (116900 vehicles) in each province; the number of hydrogen stations built (351) accounts for 30.6% of the cumulative planned number (1148) in each province in 25 years. By September 2023, Jilin, Tianjin, Guangdong and Shanghai have achieved 30-40% of the 25-year promotion target of fuel cell vehicles. Jilin and Zhejiang have achieved nearly 50% of the planned target of hydrogenation stations in 25 years.

At present, the ratio of fuel cell vehicles to hydrogen stations in China is about 50:1. Taking 49 tons of heavy trucks as an example, the hydrogen consumption is 12 kg per 100 kilometers, running 200 kilometers a day, the hydrogen consumption is 24 kg per day, and the hydrogen station with more than one ton of filling capacity can provide about 50 vehicles per day. From the perspective of provinces and cities, the station ratio in Beishengguang, Henan, Shaanxi and other places has exceeded the planned station ratio in 2025. Beijing has the highest station ratio of 157:1, followed by Shanghai 147:1, Shaanxi 106:1, Henan 77:1, Qinghai 68:1, Tianjin and Guangdong nearly 60:1, and other provinces less than 50:1.

Figure 4: Ratio of Fuel Cell Vehicles to Hydrogen Refueling Stations in Each Province and the Planned Station Ratio in 2025 Source: Orange Club Research Institute

浙公网安备33010802003254号

浙公网安备33010802003254号