this year, electrolyzer manufacturers, including Cocklear and Longji, have gone to sea to expand, and the overseas market is becoming a new pioneer for domestic electrolyzer manufacturers, and the domestic electrolyzer market is expanding in an all-round way. The first round of hydrogen auction of the European Hydrogen Bank was officially launched on November 23, with a special budget of 800 million euros (about 6.2 billion yuan). According to the terms of the auction, green hydrogen producers participate in the bidding in the form of a fixed premium per kilogram of green hydrogen produced, and the winning projects can receive subsidies. In addition to the sales revenue of self-produced hydrogen, it can receive a fixed subsidy of up to 4.5 euros per kilogram (about 35 yuan per kilogram) from the European Union for a period of ten years. However, this practice has met with the dissatisfaction of European manufacturers.

With the recovery of hydrogen energy industry, countries actively lay out hydrogen energy industry, promote energy transformation and reduce carbon emissions, which also led to the expansion of the electrolytic cell market.

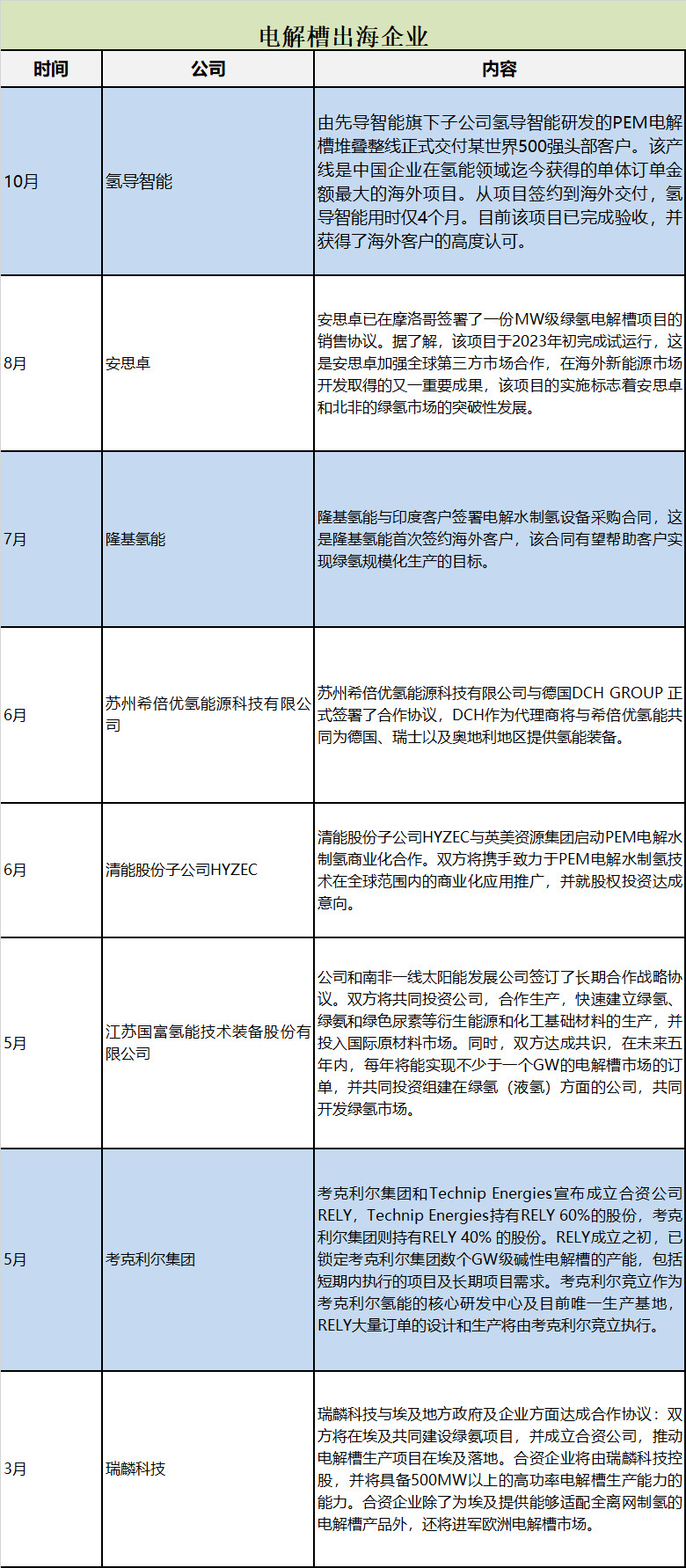

Up to now, nearly 10 domestic electrolytic cell manufacturers have cooperated with multinational manufacturers to build factories, start commercial cooperation in hydrogen production by electrolyzing water, and establish overseas companies to open up international markets and accelerate the overseas market layout of hydrogen production equipment.

At a time when countries have introduced favorable policies, it is a good time to go to sea to expand the market and promote the development of hydrogen energy industry.

But recently, the European Union's hydrogen energy subsidy policy, which was launched in October last year, has added a bit of disturbance to the Chinese electrolyzer enterprises going to sea.

Recently, with the start of the EU green hydrogen auction, more and more people are calling for EU green hydrogen subsidies to be granted only to European electrolyzer manufacturers, not to competitors from China. An auction determined

only by price, which could be disastrous for European electrolyzer manufacturers. China,

after all, had the same problem a decade ago, when European subsidies for solar PV inadvertently financed a boom in Chinese solar manufacturing, leading to the eventual collapse of the once-leading European PV industry . In

2023, the global green hydrogen market continued to grow explosively, and the performance of electrolyzer manufacturers improved significantly. Hydrogen Pro, an

alkaline electrolyzer manufacturer, broke the general loss predicament of hydrogen terminal manufacturers and made profits for the first time in the first half of this year.

At present, the global production capacity of electrolytic cells is in a stage of rapid growth, in which China and Europe play a very clever role. According to

IEA statistics, the total capacity of global electrolyzers in 2021 is 8.0 GW/year, of which the capacity of Europe and China is 3.5 GW and 2.9 GW respectively, accounting for 44% and 36% respectively.

In 2023/2025, the global total production capacity of electrolytic cells will reach 21.5 and 45.1GW/year respectively, and the total production capacity of electrolytic cells in Europe and China will account for 85%/68% of the global total; the compound growth rate of the global total production capacity of electrolytic cells will reach 54.1% in 2021-2025.

China has not been affected by the late start, and the development speed of electrolyzers has taken off, from less than 10% of the world's electrolytic hydrogen production capacity in 2020 to 30% in 2022.

By the end of 2023, the installed capacity of electrolyzers in China is expected to reach 1.2G W, accounting for 50% of the world's total capacity.

Domestic electrolytic cell specifications are also constantly breaking through. At present, many companies such as Perry Hydrogen Energy, Sunshine Hydrogen Energy, Saikesaisi, Chunhua Hydrogen Energy and Changchun Lvdong have launched products with single cell hydrogen production capacity of more than 200Nm ³/H, and are marching towards specifications of 300Nm ³/H and above on the whole.

Up to now, dozens of domestic enterprises, including China Shipbuilding Perry (formerly 718), Cockley Competition, Longji Green Energy and Sunshine Power Supply, have entered the production and manufacturing of electrolytic cells.

& nbsp; & nbsp;

& nbsp; & nbsp;

Since the beginning of this year, electrolyzer manufacturers including Cocklear and Longji have gone to sea to expand, and the overseas market is becoming a new development area for domestic electrolyzer manufacturers, and the domestic electrolyzer market is expanding in an all-round way.

Threats? Opportunity!

It is reported that the first round of hydrogen auction of the European Hydrogen Bank was officially launched on November 23, with a special budget of 800 million euros (about 6.2 billion yuan).

According to the terms of the auction, green hydrogen producers participate in the bidding in the form of a fixed premium per kilogram of green hydrogen produced, and the winning projects can receive subsidies. As the current production cost of green hydrogen is still higher than that of non-green hydrogen, the premium subsidy aims to bridge the gap between the production price and the price that consumers are currently willing to pay. In addition to the sales revenue of self-produced hydrogen, the successful bidder of the

green hydrogen auction can receive a fixed subsidy of up to 4.5 euros per kilogram (about 35 yuan per kilogram) from the European Union for a period of ten years. Bids that meet the price range criteria and other eligibility requirements will be ranked from the lowest to the highest price, and will receive subsidy support in order until the budget is exhausted.

It is precisely this that has led to the discontent of European manufacturers, who generally believe that the hidden costs and efficiency of Chinese electrolyzers are unfairly subsidized.

Earlier, on April 18, 2023, the European Parliament's Committee on the Environment, Public Health and food safety (ENVI) formally adopted the European Carbon Border Adjustment Mechanism (CBAM) agreement, which expanded the scope of the industry to cover hydrogen, and only green hydrogen was exempted from carbon tariffs due to carbon dioxide emissions from both grey and blue hydrogen production. Europe expects to use large-scale green hydrogen to promote energy transformation. On March 16,

2023, the European Commission established the European Hydrogen Bank, which will invest 3 billion euros (about $2.97 billion) to boost the local hydrogen market and industrial sector.

According to the green hydrogen plan formulated by the European Union, the European market will become one of the important export destinations for Chinese electrolyzer manufacturers in the future. Ha Kon Volldal, chief executive of

Norwegian Potter manufacturer Nel, told the same panel, entitled "expanding Potter manufacturing", that he was "brought up to support free competition, and I know that Europe wants to be the champion of global trade".

But he said it would be difficult to compete fairly with China.

"For various reasons, we can't achieve the lower costs in China, otherwise we can produce cheaper electrolyzers [in Europe]," Volldal explained.

"This is not just the labor part of assembling the electrolyzer.". This involves labor throughout the value chain-from the time you buy the raw materials to the time you make the modules and components for the electrolyzer.

Cheap Chinese hydrogen electrolyzers may become popular globally between 2025 and 2030. Cheap labor, cheap government financing. And so on. That's not fair! I don't think it's fair to open up the European market to European companies when they don't have access to the Chinese market.

He continued: "That is why, even from a fundamental point of view, I am opposed to trade barriers, but I have to agree.." I think we need some protection.

Volldal then called for the upcoming EU green hydrogen auction not to be based 100% on price factors.

According to Bloomberg New Energy Finance estimates, the price of electrolyzers in China is a quarter of the price of manufacturing equipment in Europe and the United States, which is a huge threat to foreign manufacturers facing a series of social problems such as high project costs and unstable supply chains, but an opportunity for domestic electrolyzer enterprises.

(Originally published as Old drama repeats itself?)? EU subsidies are good for Chinese electrolyzer manufacturers)

浙公网安备33010802003254号

浙公网安备33010802003254号