In 2022, the domestic soda ash inventory dropped sharply and the price rose. Stimulated by high profits, the soda ash production capacity in 2023 is planned to be more, and the accumulation is expected to be stronger.

This paper mainly analyzes the necessary conditions and the time point of the accumulation of soda ash in 2023 from the perspective of both supply and demand and industrial game. In 2023, the supply and demand structure of soda ash may show that both supply and demand are booming, the growth rate of supply is faster than demand, and the accumulation of inventory in the year is a big probability event. From the basic analysis, the domestic soda ash inventory may begin to accumulate in September, but after the release of new production capacity, the downstream can reduce the number of days of raw material inventory ahead of time, and the upstream accumulation time of soda ash may be earlier than market expectation. If yuanxing Energy puts some production lines into operation as planned in June, the upstream inventory of soda ash may accumulate by 250000 to 500000 tons around June, and the downward pressure on the price of soda ash will increase. Considering seasonal maintenance and other factors, the price of soda ash weakened sharply or occurred in the fourth quarter of 2023. In the future, investors need to focus on the extent of export reduction, the rhythm of new capacity release and the progress of upstream and downstream game. Since

2021, the current price of soda ash has risen strongly due to the expansion of photovoltaic glass production capacity. In 2022, the future price of soda ash has fluctuated in a wide range, and the price center has moved up. At present, the inventory of soda ash is at a low level, which obviously supports the price. Stimulated by high profits, soda ash production capacity will increase substantially in 2023, and the supply and demand structure is expected to reverse strongly. So when will the domestic soda ash inventory meet the turning point? What are the necessary conditions for accumulation? According to the data of

the National Bureau of Statistics, the domestic output of soda ash in 2022 was 29.2 million tons, an increase of 70000 tons compared with 29.13 million tons in 2021, an increase of only 0. In 2022, the domestic export volume of soda ash increased significantly. According to the data of the General Administration of Customs, the cumulative import volume of soda ash in China in 2022 was 114000 tons, the cumulative export volume was 2.055 million tons, and the net export volume was 194.The export volume in 2022 increased by 1.296 million tons compared with 2021, and the net export volume increased by 142. The daily melting volume of float glass increased significantly, and the sum of daily melting volume of float glass and photovoltaic glass rose to the highest level in history. In 2022, the demand for soda ash for float glass decreased by about 250,000 tons, the demand for photovoltaic glass increased by about 1.05 million tons, and the demand for light alkali remained stable as a whole.

Overall, in 2022, the domestic demand increased by about 800,000 tons, the net export increased by about 1.4 million tons, the annual output increased by about 70,000 tons, and the total domestic soda ash inventory decreased by about 2 million tons. By the end of January 2023, the total inventory of soda ash in China was about 1.8 million tons, of which the inventory of upstream production enterprises was only 300,000 tons. From late October 2022 to early February 2023, the inventory of domestic soda ash production enterprises continued to run at a low level, with the lowest futures price of about 240,000 tons and the highest of about 350,000 tons. At present, the soda ash inventory is low, the core reason is that there is no increment in the supply side, and the demand continues to increase. In order to accumulate in the future, the supply side must increase, or the demand will decrease, and the export will decrease.

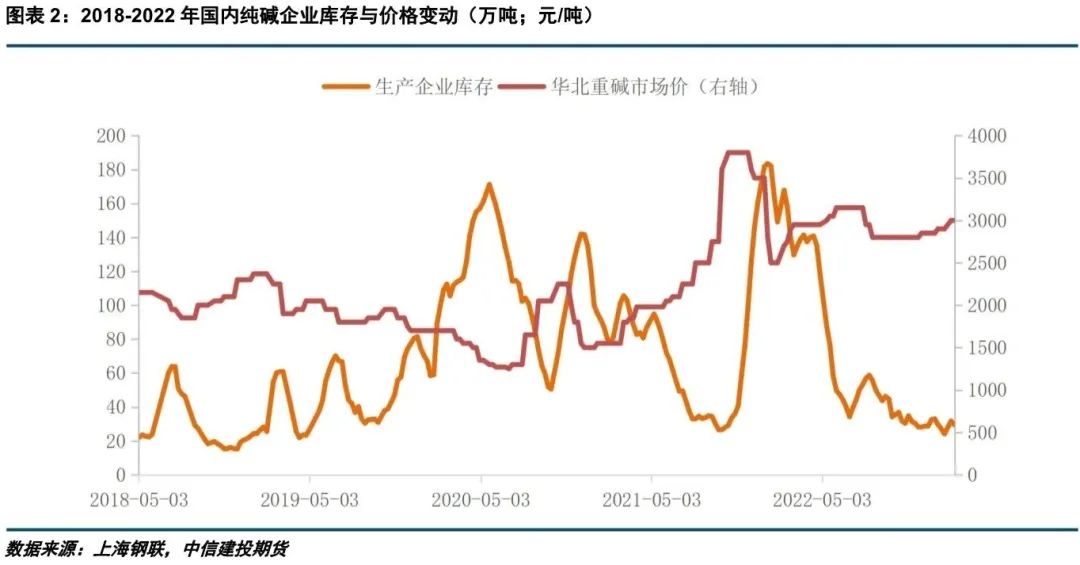

from the data of 2018-2022 that there is a direct negative correlation between the soda ash price and the inventory of production enterprises. When the supply exceeds the demand and the inventory rises, the probability of price falling is high; when the supply exceeds the demand and the inventory falls, the driving force of price rising is strong. From January 2018 to January 2023, the correlation coefficient between the inventory of soda ash production enterprises and the spot price of heavy alkali in North China is -0.17, and the correlation coefficient between the inventory of soda ash production enterprises and the spot price is -0.44. Using the data from January 2018 to October 2021, we can see that the correlation coefficient between the inventory of soda ash production enterprises and the spot price of heavy alkali in North China is -0.68, and the correlation coefficient between the inventory change of soda ash production enterprises and the spot price change is -0.

The relative change of soda ash inventory has a more significant impact on the price, but the absolute value of the inventory can not be ignored. In addition, in some cases, there may be a positive correlation between soda ash price and inventory changes, which we believe is mainly affected by factors other than supply and demand. For example, changes in the macro and cost side may lead to the same short-term price and inventory trend.

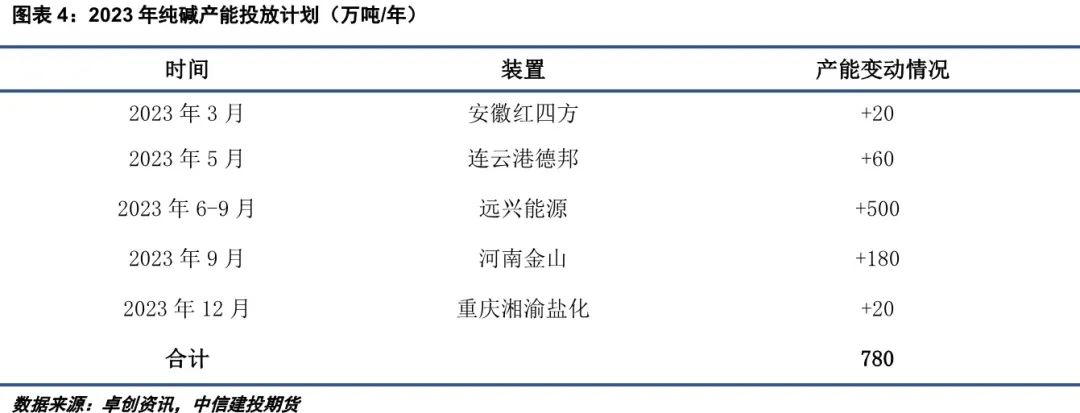

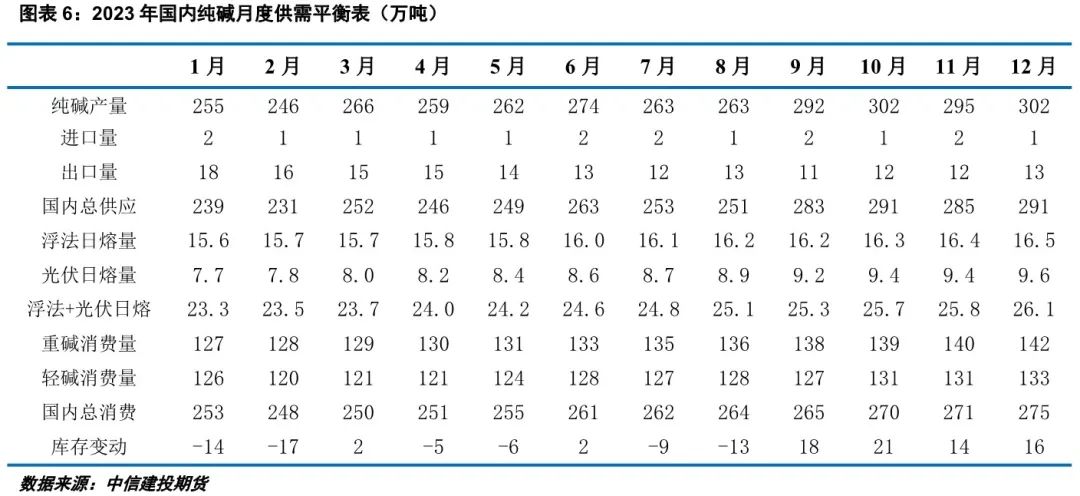

Preliminary statistics show that five enterprises in the soda ash industry plan to expand production in 2023, with an additional capacity of 7.8 million tons, accounting for about 24% of the existing capacity of soda ash. The projects planned to be put into operation in the first half of 2023 include 200,000 tons of Hongsifang and 600,000 tons of Debang. The projects planned to be put into operation in the second half of 2023 include 5 million tons of yuanxing Energy, 1.8 million tons of Henan Jinshan and 200,000 tons of Xiangyu Salinization. According to the above capacity launch plan, the new output of soda ash in 2023 will be close to 3.4 million tons, accounting for about 12% of the output of soda ash in 2022. Combined with our forecast of demand and import and export in the annual report, the domestic soda ash inventory in 2023 may fall first and then rise, and the probability of accumulation in the year is high.

yuanxing Energy's new production capacity of 5 million tons is likely to be put into operation in June-September, but July-August is the month of centralized maintenance of domestic soda ash plants. Usually, the output in July and August is 4-6% less than that in normal months. According to the monthly supply and demand balance table, the total inventory of soda ash in China in 2023 will probably begin to accumulate in September.

In terms of external demand, due to adverse factors such as interest rate hikes and geopolitical conflicts, the European and American economies are expected to fall into recession in 2023, and the overseas demand for soda ash is expected to increase or decrease. The shortage of overseas energy supply has been alleviated, and the probability of domestic soda ash export in 2023 is lower than that in 2022. Under neutral conditions, it is estimated that the average monthly export volume of soda ash in 2023 will be about 130,000 tons, and the annual export volume will be about 1.6 million tons, a decrease of about 400,000 tons compared with the same period last year. We believe that there will not be a cliff-like decline in soda ash exports in 2023, mainly because more than half of the domestic soda ash exports to Southeast Asia, the rapid development of major economies in Southeast Asia, and strong demand resilience.

On the whole, the demand for soda ash will continue to increase in 2023, and the change in demand side will hardly lead to inventory accumulation, but we need to be alert to the risk of export decline exceeding expectations.

As shown in Chart 9, the total daily melting volume of float glass and photovoltaic glass has shown an obvious increasing trend in the past three years, but the inventory fluctuation of soda ash production enterprises is more obvious, which also leads to sharp price fluctuations, mainly because futures and spot merchants and other institutions play the role of reservoir, which intensifies the upstream and downstream game. Taking heavy alkali as an example, before the listing of soda ash futures, the price fluctuation of soda ash is relatively small. The sales mode of alkali factories mainly includes direct sales and distribution, and the sales chain includes alkali factory-glass factory and alkali factory-trader-glass factory. After the listing of soda ash futures, the enthusiasm of market participation is high, the basis fluctuates widely, and the futures and spot traders are active. The sales chain of soda ash has changed into alkali factory-glass factory, alkali factory-trader-glass factory and alkali factory-commodity trader-glass factory. In 2022, 560,000 tons of soda ash futures were delivered in kind, and the volume of futures and spot and downstream price transactions was much higher than delivery volume. As the procurement channels are more abundant, downstream enterprises can increase or reduce the available days of raw material inventory to increase the voice of the game with the upstream.

Taking the market from the beginning of October 2021 to the end of December 2021 as an example, in early October 2021, affected by the double control of energy consumption, the spot market price of heavy alkali in North China once rose to 3800 yuan/ton, when the upstream inventory of soda ash dropped to around 200000 tons, and the inventory of delivery warehouse rose to about 800000 tons. The available days of soda ash storage held by float glass are about 50 days. Because of the high market price, glass enterprises take the initiative to reduce the purchase of raw materials for soda ash enterprises, purchase social stocks from futures and digest their own stocks of raw materials. In just three months, the upstream inventory of soda ash rose from 200000 tons to 1.8 million tons, the spot price fell sharply, and the main futures contract once fell below 2200 yuan/ton.

From the above cases, we can see that the activity of soda ash merchants has increased the voice of downstream glass factories to a certain extent. So in 2023, when the supply and demand structure is expected to shift from tight to loose, how and to what extent will the upstream and downstream game of soda ash affect inventory changes? Four days, equivalent to about 650,000 tons of soda ash, assuming that the available days of soda ash held by photovoltaic glass enterprises are also 20. Due to the uncertainty of new production capacity, it is difficult for glass enterprises to continue to reduce raw material inventory in the short term. Until the 5 million tons of trona project of yuanxing Energy is put into operation, glass enterprises will take the initiative to reduce the number of days of raw material inventory. According to the information disclosed by the official website of yuanxing Energy and market research information, the two production lines or ignition production of yuanxing in May and production in June, the progress of the remaining two production lines is slightly slower. It is reasonable to speculate that if yuanxing is put into production according to the above plan, glass enterprises can choose to reduce raw material inventory in June to reduce the loss caused by falling prices. Under extreme conditions, the safety stock of raw materials of glass enterprises can be reduced to 7-15 days; assuming that glass enterprises reduce the stock of raw materials to 15 days in June, the supply of soda ash in circulation in the market may increase by 250,000 tons; if the stock is reduced to 10 days, the supply of soda ash in circulation may increase by 500,000 tons.

Combined with the above balance sheet, we believe that the upstream and downstream game may lead to the accumulation of soda ash upstream ahead of schedule, and the timing of the advance depends on the production progress of yuanxing Energy Project. According to the current production schedule of yuanxing, the probability of upstream inventory accumulation will be advanced to June, but because the current raw material inventory of delivery warehouse and glass factory is at a low level in the past two years, the upstream inventory increment in June is relatively limited, and it is estimated that the range of inventory accumulation will be 250000 to 500000 tons. If we want to further accumulate stocks, we need to wait until the end of the summer maintenance season and the release of other production capacity, soda ash stocks will accumulate or accelerate around September, and the price pressure will increase significantly.

< IMG SRC = "More soda ash production capacity is planned to be put into operation in the https://np-newsimg.dfcfw.com/download/D24618081005898845534_w1080h576.2023 year, and the accumulation is expected to be strong.". In 2023, the supply and demand structure of soda ash is expected to turn loose, and the supply growth rate is faster than demand or lead to inventory accumulation. From the basic analysis, the domestic soda ash inventory may begin to accumulate in September, but after the release of new production capacity, the downstream can reduce the number of days of raw material inventory ahead of time, and the upstream accumulation time of soda ash may be earlier than market expectation. According to the current production plan of yuanxing, the upstream inventory may accumulate by 250000 to 500000 tons around June, when the downward pressure on soda ash prices will increase. Considering seasonal maintenance and other factors, the price of soda ash weakened substantially or occurred in the fourth quarter of 2023. In the future, investors need to continue to pay attention to the extent of export reduction, the rhythm of new capacity release and the strength of upstream and downstream game.

浙公网安备33010802003254号

浙公网安备33010802003254号