Germany has the most modern, efficient and environmentally conscious cement industry in the world. Cement production began in 1877. In the first 50 years of the 20th century, cement production grew rapidly due to the impact of World War II and post-war reconstruction. The oil crisis of the 1970s had a major impact on the German cement industry, leading to two major shifts in the industry. The first is the conversion of the production line to a larger, more thermally efficient dry process, increasing cement production from 350 to 2,400 tons per day, and the second is the initial research into alternative fuels for cement production, which is now yielding significant results.

Current production and marketing trends

According to the German Cement Engineering Association (VDZ), German cement consumption increased by 2.2% to 27.1 million tons in 2014, compared with 26.5 million tons in 2013, a decrease of 1.1%. In 2014, the output of German cement enterprises can basically meet the domestic demand for cement, only 1.3 million tons, and about 4% of the consumption needs to be imported. In 2014, the export volume of cement and clinker fell to 6.2 million tons year-on-year, and with domestic cement consumption, the total output of cement in Germany in 2014 was 32 million tons.

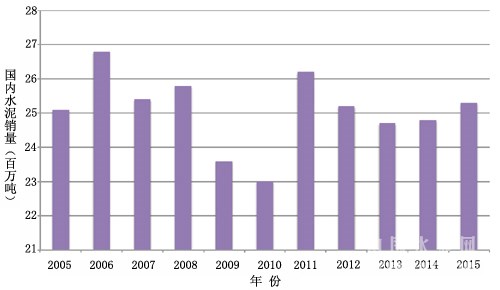

Figure 1: Change of cement production and sales volume of VDZ member enterprises from 2005 to 2015

Source: VDZ

In 2015, the cement output of VDZ member enterprises in Germany decreased by 2% year-on-year to 24.8 million tons, compared with 25.3 million tons in 2014 (see Figure 1), which is comparable to the output level ten years ago. Before the global financial crisis, German cement production was already on a downward trend, peaking at 38 million tons in 2000. The demand for cement after 2000 was mainly due to a slowdown in the construction sector caused by an unfavourable demographic and taxation system, a decline in investment and a decline in the number of public and state-funded construction projects.

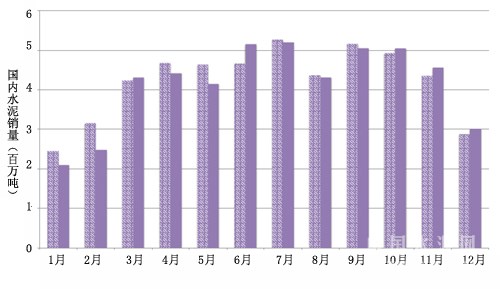

Compared with 2014, German cement production in the second half of 2015 was significantly better than that in the first half (see Figure 2). In the first quarter of 2015, the output decreased by 9.7% year-on-year, in the second and third quarters, the output decreased by 1.8% and 1.6% year-on-year, and in the fourth quarter, the output increased by 3.7% year-on-year. The reason may be that the weather was better in the fourth quarter and the construction was better than same period last year.

Figure 2: Comparison of cement production in each month of 2014-2015

Source: VDZ

Cement market situation

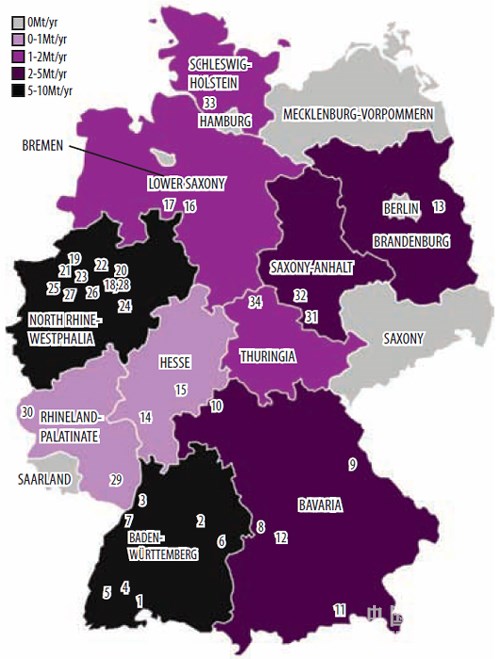

The German cement industry has 34 integrated cement plants with a total cement capacity of 32 million tons per year (see Figure 3), and 21 grinding stations in China. Some large multinational cement manufacturing enterprises, local large enterprises and single-line production enterprises share the German cement market.

Five multinational cement groups, Heidelberg Cement, Dyckerhoff (Buzzi Unicem), Lahau, Opterra (CRH) and Cemex, have a total cement production capacity of 21.3 million tons per year in Germany, accounting for about 67% of the total cement production capacity in Germany. Schwenk Zement, the only local leading enterprise, has four integrated cement plants with a total capacity of 4.1 million tons per year, accounting for about 13% of the country's total capacity. The remaining 20% of the 6.3 million tons/year capacity is scattered among single-line cement manufacturers in Germany. Such a high proportion of single-line cement production enterprises is not common in large cement markets and developed countries. These enterprises are independent or family enterprises, which is an important form of organization in the European cement industry.

Table 1: Production Capacity of Top 6 Enterprises in German Cement Industry

Table 2: Distribution of cement production capacity in German States in 2016

Figure 3: Distribution of cement production capacity in Germany

Alternative Fuels & emsp; & emsp;

In the first 100 years of the history of German cement industry, coal was the preferred fuel for cement plants. Since the 1970s, coal has been gradually replaced by petroleum coke and alternative fuels. In the 1990s, the application of alternative fuels has flourished. Due to the relatively early application of alternative fuels, Germany has become the country with the highest substitution rate of alternative fuels in the world. In view of the scale of the German cement industry, the German cement industry has also become the country with the highest proportion of alternative fuels in the world.

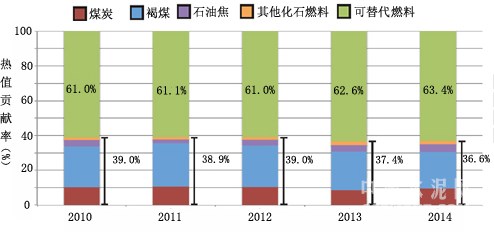

According to the latest VDZ data, the proportion of alternative fuels in the German cement industry reached 63.4% in 2014 (see Figure 4). This corresponds to 5860 million GJ/year. The second largest fuel is lignite, accounting for 9.6% of the total fuel, followed by coal (9.6%) and petroleum coke (4.4%). Figure 4 shows the proportion of various wastes used as fuels in the German cement industry in 2010-2014. Whether the consumption of alternative fuels in 2015 can maintain the same growth as in 2013-2014 will have to wait for the updated data of VDZ.

Figure 4: Change of Calorific Value Contribution Rate of Various Fuels in German Cement Industry from 2010 to 2014

Outlook

The German government's annual economic report for 2016, published in January 2016, pointed out that German GDP growth in 2016 is expected to be 1.6%, down from the previous forecast of 1.8%. In December 2015, the German Central Bank expected GDP growth of 1.8% in 2016 and 1.7% in 2017. These figures suggest that Germany's construction industry will continue to grow at its current pace in the coming years. Overdue major public investment in infrastructure construction is a major positive stimulus for construction companies and cement producers. Given that Germany has received about 1 million refugees and other immigrants, investment in infrastructure and new housing construction will be more likely to be realized.

浙公网安备33010802003254号

浙公网安备33010802003254号