On July 15, 2015, as soon as the Lahao merger was settled, Heidelberg Cement Group released another big news in the global cement industry: the Group announced the acquisition of 45% of Italian Cement. The German company, already the world's second largest cement manufacturer in terms of production capacity, bought a 45% stake in Italian cement at a price of 10.6 euros per share on July 28, 2015. But this is just the beginning. Heidelberg Cement aims to buy 100% of its Italian rival.

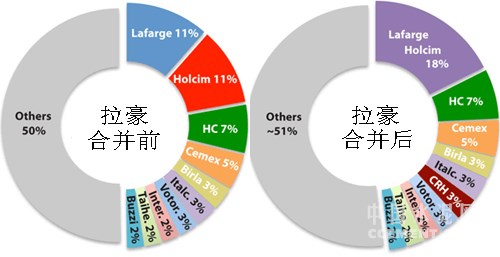

Over the past 18 months, the global cement industry has experienced a major event with the Lafarge-Holcim merger. In order for the merger to be approved, Lahore had to sell various assets around the world, most of which were acquired by Old Castle Cement of Ireland in August 2015. As a result, the ranking of the top ten cement enterprises in the world has changed greatly (see Figure 1).

Figure 1: Proportion of global capacity (including clinker and cement) of multinational cement companies before and after the Lahau merger

After the end of the merger, Lahao became the second largest cement manufacturer (340 million tons/year) after China Building Materials (388 million tons/year). If only multinational cement manufacturing enterprises are considered (for example, excluding Chinese cement manufacturing enterprises), Lahao is the largest cement enterprise in the world, and the second largest multinational cement enterprise is Heidelberg Cement in Germany, with a cement production capacity of 129 million tons per year. If Chinese cement enterprises are included, Heidelberg ranks fifth in the world.

Italian cement ranks fifth in the list of multinational cement, with a cement production capacity of 71 million tons per year. Without the knowledge of other companies in the industry, Italmobiliare, a 45% shareholder of Italian Cement, has reached the final stage of selling its stake to Heidelberg Cement.

Heidelberg Cement announced on July 28, 2015 that the company had taken over Italmobiliare's controlling stake in Italian Cement, which shocked the global cement industry. Heidelberg initially bought a 45% stake in Italcementi for 1.67 billion euros, a deal that still needs to be approved by the Competition Commission. Once the preliminary deal is approved, Heidelberg will then buy out outside investors for the same price. Heidelberg's offer is 61% higher than group's closing price before the announcement of the transaction, which is high but within a reasonable range to ensure that the group can obtain 100% of the Italian cement.

The acquisition of Italcementi will help expand Heidelberg's presence in Mediterranean countries such as Italy and Egypt, as well as France and Belgium, which are Italcementi's largest markets.

"With the gradual recovery of the markets in southern Europe and the US, now is a good time for us to expand," HeidelbergCement's CEO Bernd Scheifele said. The deal gives HeidelbergCement a huge boost in the Middle East and Africa, doubling the company's market share in these regions. The deal will be paid in cash, underwritten by Deutsche Bank and Morgan Stanley, and partly repaid through asset sales, details of which have not yet been announced.

………………

Members: Please log in to continue reading!

Non-member units: Please enter the public resource library of China Cement Online Mall to purchase and continue reading!

浙公网安备33010802003254号

浙公网安备33010802003254号