Germany is located in the central part of Europe, consisting of 16 States, with a land area of 357127 square kilometers and a population of 80.9 million, making it the second most populous country in Europe after Russia. Germany is the largest economy in Europe and the sixth largest in the world, with a GDP of 3.39 trillion euros in 2014.

Economy.

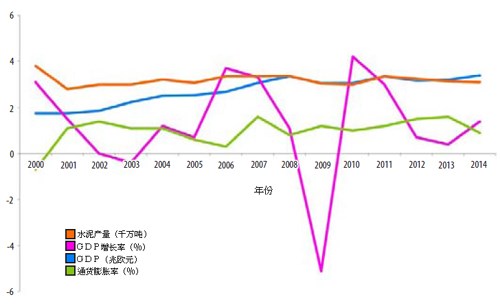

Germany has the strongest economic strength in Europe, with a total GDP of 3.39 trillion euros in 2014, up 1.6% year-on-year, an increase of 1.1 percentage points over 2013. GDP per capita was €446 39758 in 2014, up from €446 in 2013; inflation was down to 0.9% from 1.6% in 2013.

Germany has a strong manufacturing industry and is the world's leading manufacturer of iron, steel, chemicals, automobiles and machinery. In 2014, industrial output increased by 1.3% year-on-year, a significant increase from 0.3% in 2013. Germany is the world's fourth largest exporter and importer, with exports of 1.38 trillion euros in 2014, up slightly from 1.35 trillion euros in 2013, and imports of 1.18 trillion euros, up from 1.12 trillion euros in 2013.

Like many developed countries, 73.8% of Germany's 44.8 million labor force is employed in the service sector, while only 24.6% and 1.6% of the industrial and agricultural labor force, respectively. Since 2004, the number of German workers has been declining steadily, and the long-term sustainable development of the economy has been closely watched. In 2014, the birth rate of German population was 8.42 per thousand, the death rate was 11.29 per thousand, the net immigration rate was 1.06 per thousand, and the overall population shrank by 0.18% compared with 2013. Germany's unemployment rate is one of the lowest in Europe and has continued to decline slightly, to 5% in 2014, down 0.3 percentage points from 2013.

Overview of Cement Industry

Figure 1: Cement production (10 million tons), GDP growth rate (%), GDP (trillion euros) and inflation rate (%) from 2000 to 2014

The German cement industry began in 1877, and the first cement standard was established in 1878. The German cement industry grew steadily until the 1950s, when the post-war construction boom caused a sharp rise in domestic demand for cement. In the following years, the efficiency of the German cement industry was rapidly improved. In 1960-1970, wet cement kilns were closed, which reduced energy consumption. By the 1970s, the daily capacity of cement kilns increased from 350 tons to 2400 tons. In 2015, almost all the cement production lines in Germany were new dry process with more energy saving, and all the new cement plants were cyclone preheater decomposition kilns, equipped with three-stage air ducts and grate coolers. According to the German Cement Enterprises Association VDZ, there were 41 cyclone preheater kilns, 6 grate preheater kilns and 8 shaft kilns in Germany in 2013.

In 2014, German cement consumption increased by 2.2% year-on-year to 27.1 million tons. In 2013, cement consumption was 26.5 million tons, down 1.1% year-on-year, as bad weather restricted construction activities in the construction industry. In 2014, Germany's domestic cement enterprises can basically meet the domestic demand for cement, only 1.2 million tons, 4% of the consumption is imported cement, and the export of cement and clinker is also declining year by year, only 6.2 million tons in 2014.

Gerhard Hirth, chairman of VDZ, said: "The catch-up effect since 2013 and mild weather conditions have led to a significant increase in cement consumption, especially in the first quarter of 2014." However, the generally prolonged economic environment has a slight dampening effect on construction investment later in the year. "Cement demand increased significantly throughout 2014, primarily in the real estate sector," Hirth said. In addition, due to the advantages of concrete structures in multi-storey buildings, cement companies have managed to further increase their market share in recent years. Hirth believes that the outlook for the German cement industry in 2015 is optimistic. "Given the dynamic development of the overall economy and the continued high demand for new housing, we believe that cement consumption will increase by 1% year-on-year in 2015, reaching 27.3 million tons."

Since the peak of cement production of 38 million tons in 2000, the cement production in Germany has been relatively stable in the last decade. Although it declined in 2009 due to the outbreak of the global financial crisis, the overall change is not significant. Similarly, clinker production capacity has not changed much since it dropped from 40 million tons per year to 31 million tons per year in 2000. The decline in cement demand in 2000 was due to a slowdown in the construction industry, an unfavourable demographic and tax structure, which reduced investment and public and government investment in construction projects. The USGS (United States Geological Survey) reported that German cement production in 2014 decreased by 0.96% year-on-year to 31 million tons.

Cement enterprises.

There are 34 integrated cement plants in the German cement industry, with a comprehensive capacity of about 32.13 million tons per year and 21 grinding stations. There are large multinational cement enterprises, domestic cement producers and single-line production enterprises in the cement market. The most densely populated regions, North Rhine-Westphalia, Bavaria and Baden-Württemberg, are the places where cement enterprises gather and have the largest cement production capacity.

Heidelberg Cement has eight cement plants with a capacity of 7.6 million tons per year, accounting for 23.7% of the national cement production capacity in Germany, and is the largest cement producer in Germany. Heidelberg Cement also has five grinding stations, namely Kdnigs in Baden-Württemberg, Mahl-werk Mainz in Rhineland-Palatinate, Ennigerloh and Geseke in North Rhine-Westphalia, and Hanover in the Federal State of Saxony. Founded in 1873, Heidelberg Cement produces ordinary Portland cement, specialty cement and white cement, as well as concrete products and aggregate products. The Group operates in more than 40 countries, ranking 5th among the top 100 cement companies in the world in 2014.

Figure 2: Integrated cement production line in production in Germany in 2015

Source: The Global Cement Directory 2015 and Global Cement Directory 2016 Forecast

Baden-Württemberg (Baden-Württemberg) (6.88 million tons/year)

1.Schwenk Zementwerk KG, Allmendingen, 1 Mt/yr

2.Schwenk Zementwerk KG, Mergelstetten, 1 Mt/yr

3.HeidelbergCement AG, Leimen, 0.8Mt/yr

4.HeidelbergCement AG, Schelklingen, 1.5Mt/yr

5.Holcim (LafargeHolcim), Dotternhausen, 0.78Mt/yr

6.Marker Zementwerke GmbH, Harburg, 1 Mt/yr

7.CRH (formerly Lafarge Zement), Wossingen, 0.8Mt/yr

Bavaria (4.62 million tons/year)

8.Schwenk Zementwerk KG, Karlstadt, 1.2Mt/yr

9.HeidelbergCement AG, Burglengenfeld, 1.1Mt/yr

10.HeidelbergCement AG, Lengfurt, 1Mt/yr

11.Sudbayrisches Portland Zementwerk (SPZ) (HeidelbergCement AG), Rohrdorf, 0.9Mt/yr

12.Solnhofer Portland Zementwerke GmbH, Solnhofen, 0.42Mt/yr

Brandenburg (1,900,000t/a)

13.Cemex OstZement GmbH,Rudersdorf,1.9Mt/yr

Hesse (400,000 tons/year)

14.Dyckerhoff AG (Buzzi Unicem), Amoneburg, 0.2Mt/yr (white cement)

15.Zement und Kalkwerke Otterbein GmbH&Co KG,GroBenluder,0.2Mt/yr

Federal State of Saxony (1.9 million tons/year)

16.Holcim(LafargeHolcim),Hover,1 Mt/yr

17.HeidelbergCement AG,Teutonia,0.9 Mt/yr

North Rhine-Westphalia (9.52 million tons/year)

18.DyckerhoffAG (Buzzi Unicem), Geseke, 0.4Mt/yr

19.DyckerhoffAG (Buzzi Unicem), Lengerich, 1.77Mt/yr

20.HeidelbergCement AG, Paderborn, 0.4Mt/yr

21.HeidelbergCement AG, Zementwerke Ennigerloh, 1 Mt/yr

22.Seibel und Sohne Portland-Zementwerke, Erwitte, 0.6Mt/yr

23.Portland Zementwerke Gebr. Seibel GmbH & Co KG, Erwitte, 0.55Mt/yr

24.Portlandzementwerke Wittekind Hugo Miebach Sohne, Erwitte, 1 Mt/yr

25.Holcim (LafargeHolcim), Kollenbach, 0.95Mt/yr (formerly Cemex West)

26.Spenner Zement GmbH & Co KG, Diamant, 1 Mt/yr

27.Phoenix Cement, Zementwerke Krogbeumker GmbH & Co KG, 0.5Mt/yr

28.HeidelbergCement AG, Geseke, 0.9Mt/yr

Rhineland-Palatinate (950,000 tons/year)

29.DyckerhoffAG (Buzzi Unicem), Gollheim, 0.8Mt/yr

30.Portland Zementwerk Wotan H Schneider KG, Uxheim, 0.15Mt/yr

Saxony-Anhalt (3.16 million tons/year)

31.Schwenk Zementwerk Bern burg, Bernburg, 0.86Mt/yr

32.CRH (formerly Lafarge Zement), Karsdorf, 2.3Mt/yr

Schleswig-Holstein (1.5 million tons/year)

33.Holcim (LafargeHolcim), Lagerdorf, 1.5Mt/yr

Thuringia (1.5 million tons/year)

34.DyckerhoffAG (Buzzi Unicem), Deuna, 1.3Mt/yr

浙公网安备33010802003254号

浙公网安备33010802003254号