Colombia is the third most populous country in Latin America and will soon become the fourth largest economy in South America and the 31st largest in the world. Despite its long-standing internal contradictions, Colombia is being favored by foreign investment, which will break the balance and help Colombia achieve its long-awaited economic success.

In 2014, Colombia's nominal GDP was estimated at $516.6 billion, with a compound annual growth rate of 4.5% expected between 2015 and 2018, and GDP will reach $616.5 billion in 2018.

Figure 1: Real GDP (constant prices, billions of US dollars)

Source: CW Research

Increase expenditure on infrastructure construction

The construction industry, which is currently growing at an average annual rate of 10%, plays a key role in the current economic development of Colombia, mainly due to the expected implementation of the "fourth generation network (4G network)" infrastructure project.

The government is trying to achieve this ambitious plan through the PPP (public private partnership) model, building more than 8000 kilometers of roads (the flagship project of the plan, known as the "Prosperity Highway Project"), which is one of the largest highway expansions in Latin America. A total investment of more than $7.22 billion is required. A total of $100 billion

Under the 4G project plan, a total of $100 billion will be needed for infrastructure construction by 2021, and the construction industry is expected to achieve the largest profit growth since the global financial crisis.

Cement industry: an opportunity to meet growing demand

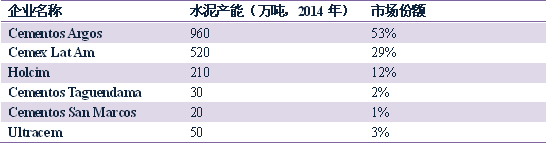

The Colombian cement market is home to six major (and one small) cement producers: Cementos Argos, Cemex LatAm, Holcim, Cementos Taquendama, Cementos San Marcos and Ultracem. They have a total of 20 grinding stations.

Cementos Argos, which has the largest share of the market, is also Colombia's largest cement producer, followed by Cemex Lat Am and Holcim. Companies such as Cemex Lat Am and Cementos Argos plan to build new cement factories. They are betting that demand for cement will increase once large-scale infrastructure projects start.

In 2012, Cemex began launching IPOs in certain Latin American regions, including Colombia. With the completion of the IPO in Colombia, the company believes that the price of cement in Colombia and the market conditions are favorable, and it needs capital to expand the scale of operation. In addition, Cemex hopes the move will help it better compete with Cementos Argos.

Cement market structure

Cementos Argos, Cemex Lat Am and Holcim produce most of Colombia's cement, while Cementos Taguendama, Cementos San Marcos and Ultracem are new entrants trying to penetrate the market on an ongoing basis. Gain market share with low price strategy. Cementos Taguendama operates a 300,000-tonne-per-year grinding plant in Cudinamarca province, while Cementos San Marcos has a 200,000-tonne-per-year capacity facility in Yumbo. Ultracem is also a new entrant to the Colombian cement market, having recently started operating a 500,000 tonne per year grinding plant in Barranguilla.

Table 1: Production capacity and market share of cement enterprises in Colombia

Source: CW Research

Figure 2: Distribution of cement plants in Colombia

Source: CW Research

Colombia produces both grey cement and white cement, while most enterprises mainly produce grey cement. Consumption of white cement increased by a compound annual rate of 8.3% between 2005 and 2014. The Nare cement plant in Cementos Argos is the only enterprise in Colombia that produces white cement (switching between white/grey cement production). Although Colombia used to export, it has recently become an importer of white cement.

The Colombian cement market is still dominated by bagged cement, and retail sales are the main part of cement demand. In the center of a big city, there will be ready-mix concrete dealers, and they will use bulk cement. For the latter, there are three main buyers of cement: governments, big construction companies (bidding on major construction projects), and ordinary homeowners. The first two types of buyers account for 40% of cement demand, while the remaining 60% is used for self-built housing.

Stabilize prices

When there are only three major producers, prices are generally increasing. This trend began to reverse after new producers upset the long-term supply-demand balance. On the other hand, when demand starts to shrink, construction and housing projects are put on hold because of funding problems, and producers make some offsets with higher prices. However, in 2014, prices began to stabilize and the decline slowed down. On the Caribbean coast of Colombia, the price of 50 kg bags has fallen by 30%.

In 2013, allegations of fixed prices in Colombia's cement industry led to an investigation into the matter, when price increases exceeded the rate of inflation. Subsequently, the increase in prices began to slow down as demand grew and competition intensified, leading us to believe that Colombian cement prices will be further aligned with those in the rest of the continent.

CW Research estimates that Colombian cement production and sales will continue to grow. With the launch of new production capacity, the utilization rate of production capacity will be under pressure and will remain below 80% from 2015 to 2018.

Demand outlook for cement industry in Colombia

CW Research believes that Colombia is poised to become the next growth story in Latin America and is ripe for inward investment. Heavy industry, especially infrastructure, will be the biggest winner. Like a house, the foundation of the new Columbia will be built on top of the cement industry. Huge infrastructure spending will go directly to transport (mainly roads) and housing, where the key raw material is cement.

浙公网安备33010802003254号

浙公网安备33010802003254号