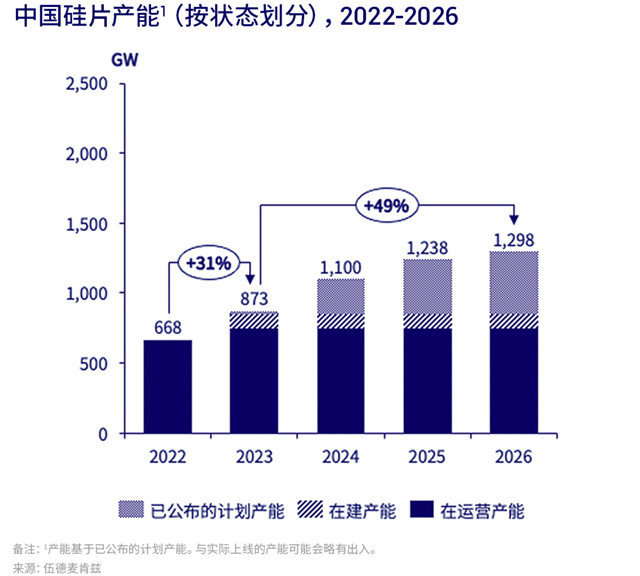

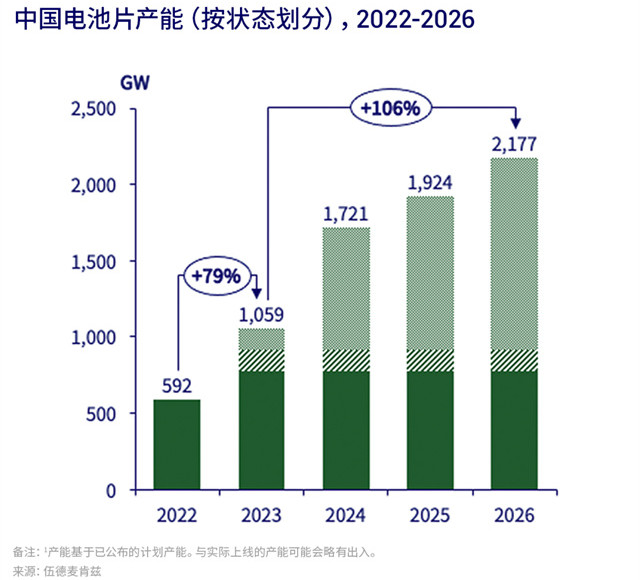

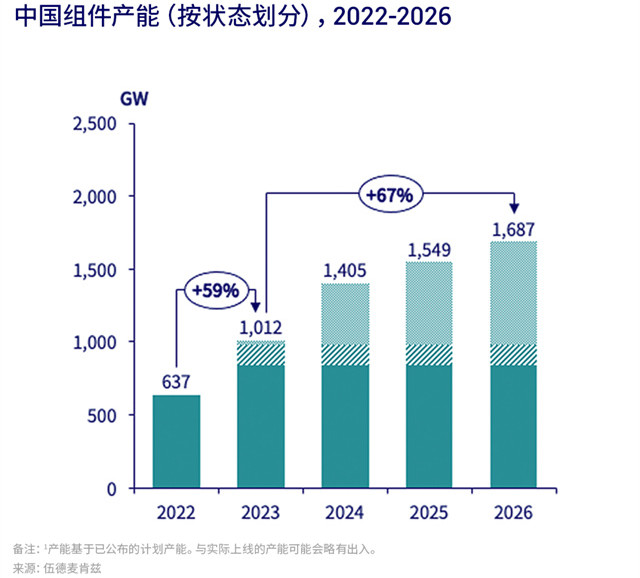

According to Wood Mackenzie's tracking statistics, by 2024, the domestic production capacity of silicon wafers, cells and photovoltaic modules will exceed 1 TW. Among them, the expansion rate of battery manufacturing capacity will exceed the growth rate of silicon wafers and components. China's strong photovoltaic supply chain and highly competitive component prices have occupied the overseas market. In order to protect the development of local photovoltaic industry , overseas countries have issued various policies for Chinese photovoltaic enterprises.

The original text is as follows:

The expansion rate

of China's cell production capacity will exceed the growth rate

of silicon wafer and module production capacity. Technology iteration and vertical integration of industrial development have led to the rapid growth of China's PV module production capacity in all sectors. According to the tracking statistics of Wood Mackenzie's PV Supply Chain Database PV Pulse, by 2024, the domestic production capacity of silicon wafers, cells and photovoltaic modules will exceed 1 TW. Among them, the expansion rate of battery manufacturing capacity will exceed the growth rate of silicon wafers and components.

It is expected that the battery will become the most competitive link in the component supply chain. According to the statistics of Wood Mackenzie database, 87% of the cell expansion plans adopt the new N-type technology . Market concerns about oversupply are mainly due to the consideration of old product lines with low power generation efficiency, such as P-type and M6 cells. If the announced planned capacity is added, the global production capacity of P-type cells will be more than four times its demand by 2026. The surplus P-type cell production line needs to be upgraded to TOPCon cell production line as soon as possible, otherwise it will be gradually shut down.

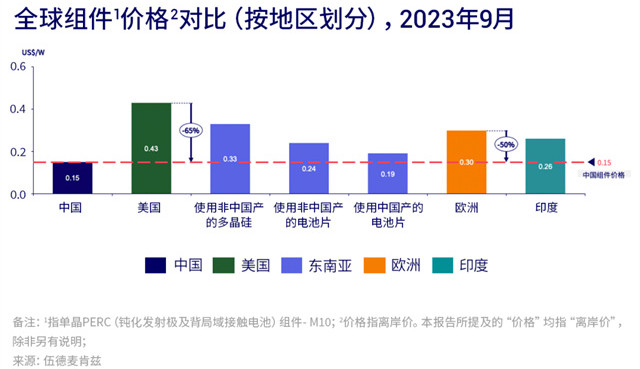

The price of modules made in

The price of modules made in

China is much lower than that in Europe or the United States.

Faced with the strong photovoltaic supply chain and price competitiveness of modules made in China, overseas markets have introduced strong policies to support the development of local photovoltaic manufacturing industry. However, compared with the components made in China, the cost price of components in overseas markets is still not competitive.

Under the incentives and subsidies of the Inflation Reduction Act (IRA), the United States is rapidly developing its own photovoltaic supply chain. However, the United States lacks the production capacity of silicon wafers, cells and photovoltaic glass, and the upstream raw materials are still dependent on imports. With advanced technology, cost advantages and perfect supply chain, the price of locally manufactured components in China is 65% lower than that in the United States. The price of components produced in

Europe is twice that of Chinese components, which lacks market competitiveness and hinders sales. This has also led local suppliers to call on the European Commission to impose tariffs on module products imported from China to protect the local photovoltaic manufacturing industry.

In order to protect the development of local photovoltaic manufacturing industry, the Indian government has set basic tariffs of 40% and 25% on imported photovoltaic modules and cells, respectively. However, at present, the local battery production capacity can not meet the manufacturing demand of its components, and it needs to rely on the supply of China and Southeast Asia to make up for the gap. The basic tariff on imported photovoltaic cells has also pushed up the cost of local components in India, thus reducing its competitiveness in the international market.

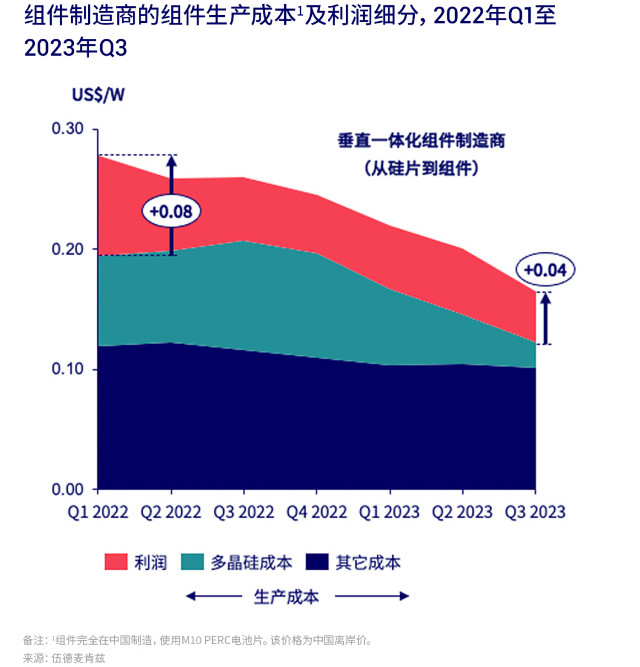

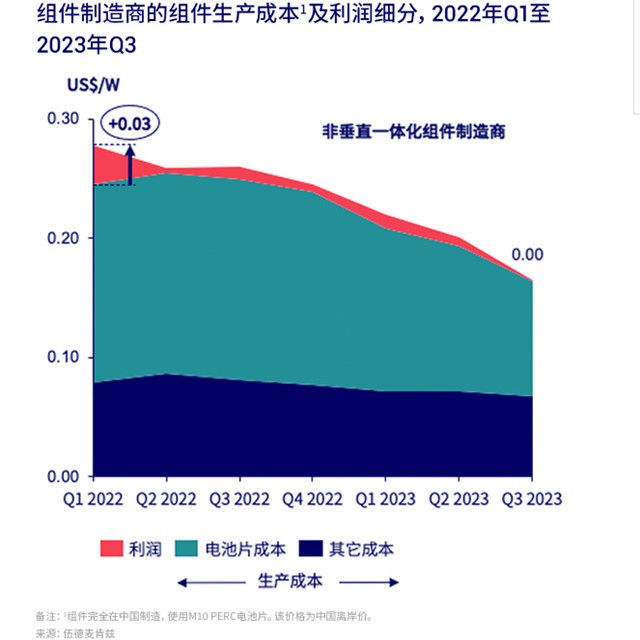

Non-integrated module manufacturers

have reached the break-even point

in the third quarter of 2023. In the face of the current domestic oversupply situation, manufacturers have adopted aggressive bidding strategies to actively seize market share at low prices. Vertically integrated manufacturers, with their own upstream supply chain capacity (cells or wafers), can better reduce component manufacturing costs and win more orders through price reduction strategies.

For non-integrated component manufacturers that purchase parts from outside, as of the third quarter of 2023, the market price is almost the same as the manufacturing cost, and there is no profit margin. If market prices fall further, non-integrated component manufacturers will be forced to take orders at a loss, reduce capacity utilization, and even face the risk of bankruptcy.

浙公网安备33010802003254号

浙公网安备33010802003254号