of Jingsheng Mechatronics, plans to sprint to the GEM IPO after the split. Despite the high asset-liability ratio, the company's revenue and net profit increased significantly year on year. Qiu Minxiu, the actual controller behind the two companies, is a retired teacher from Zhejiang University. At the age of 61, he has made remarkable achievements in the photovoltaic industry . Can Meijing New Material go public smoothly and create a new capital story? In this context, photovoltaic practitioners have received a lot of dividends. From 2020 to 2022, the revenue of Jingsheng Mechatronics, the leader of photovoltaic equipment, soared from 3.811 billion yuan to 106.

However, as a high-input industry, the demand for capital is not small. Even though revenue has soared, the cash flow of Meijing New Material is still tight, and the highest asset-liability ratio has reached 105. The actual controllers behind the company are Qiu Minxiu, a former professor at Zhejiang University , and his student Cao Jianwei . Qiu Minxiu is now 78 years old. Can elderly female boss hold the second listed company as she wishes? 45%

According to the official website of the Ministry of Industry and Information Technology, the total output value of the photovoltaic industry exceeded 1.4 trillion yuan in 2022; By the end of 2022, the total market value of 138 listed photovoltaic companies was as high as 3.

Meijing New Material mainly sells quartz crucible, which is similar to a large milky white cup, and is a container with high purity and strong temperature resistance. It is usually used to directly hold polysilicon materials, which are heated and melted and then processed into silicon rods and wafers for the production of downstream semiconductor chips, photovoltaic panels and other products. Therefore, quartz crucible belongs to the upstream of the photovoltaic industry chain and plays an important role in the photovoltaic industry.

The popularity of Oujing Technology can not be separated from the general trend of strong demand for quartz crucibles. The demand for photovoltaic quartz crucibles increased from 313,300 in 2020 to 59 in 2022.

Meijing New Material also benefited. The prospectus shows that the operating income of Meijing New Material has increased substantially, and the attributable net profit has changed from loss to profit. From 2020 to 2022, business income rose from 44 million yuan to 1.073 billion yuan, revenue growth in 2021 and 2022 reached 293.53%, net profit in 526.3 years was-3.3407 million yuan, 15.2114 million yuan and 301 million yuan, respectively. Year-on-year growth of 555.34% and 1877 respectively. Among them, net profit in 2022 increased by more than 18 times year-on-year.

In addition, in the first quarter of 2023, the company's operating income was 544 million yuan, which has reached half of the whole year of 2022.

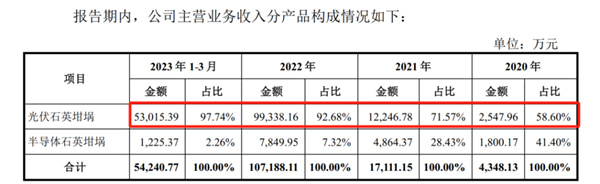

Ninety percent came from photovoltaic quartz crucibles . From 2020 to 2022, the revenue of photovoltaic quartz crucible was 0.25 billion yuan, 122 million yuan and 993 million yuan, accounting for 58.6%, 71.57% and 92.2023 respectively.

Source: "Prospectus"

In terms of growth rate, from 2021 to 2022, the growth rate of photovoltaic quartz crucible revenue was 380.65% and 711% respectively. The significant increase in the revenue of photovoltaic quartz crucible was mainly affected by the increase in product sales volume and the increase in unit price.

Specifically, from 2021 to 2022, the company's sales of photovoltaic quartz crucibles rose from 27 thousand and 700 to 113 thousand and 400, up 309.53%; By the end of the first quarter of 2023, the unit price of photovoltaic quartz crucibles had reached 14.6 million yuan, compared with 0.29 million yuan in 2020, the unit price of photovoltaic quartz crucibles had increased by 403

in only two years and three months. Photovoltaic quartz crucible has become the pillar of the company's performance, with the average unit price doubling and sales volume tripling. At this juncture, it is not unreasonable for Meijing New Material to choose to sprint IPO. According to the prospectus, Meijing New Material currently ranks first in the market share of semiconductor and photovoltaic quartz crucibles in China, with a market share of 23.

However, it seems that Meijing New Material does not want to be confined to the upstream field. Speaking of future planning, Meijing New Material said that in the future, it will further expand downstream application areas, develop new products and services based on demand, and further enhance the status of the industry.

1.

From 2020 to 2022 (hereinafter referred to as the "reporting period"), the net cash flow generated by the operating activities of Meijing New Material was -20.8756 million yuan, -112 million yuan and -1 yuan respectively. It was not until the first quarter of 2023 that it turned positive. The net cash flow generated from investment activities was negative during the reporting period, and was still -1 in the first quarter of 2023.

Source: The

only positive item in the Prospectus was the cash flow generated from financing activities. From 2020 to 2022, it is 50.1411 million yuan, 210 million yuan and 8 yuan respectively.

In this case, Meijing New Material can only expand production by borrowing money, but this also brings the company an asset-liability ratio of more than 70%. In the first quarter of 2020- 2022 and 2023, the asset-liability ratio of Meijing New Material was 105.75%, 96.59%, 83.27% and 75.8%, respectively.

The prospectus shows that the high asset-liability ratio is mainly due to the large amount of investment in assets such as plant and equipment in recent years. It mainly supplements the required funds through debt financing such as bank loans.

Meijing New Material is optimistic, and said that in the first quarter of 2020-2023, the company's asset-liability ratio showed a downward trend, operating conditions and profitability continued to improve, which will drive the increase of net assets and capital strength year by year.

It is worth mentioning that as of the first quarter of 2023, Meijing New Material held 313 million yuan of monetary funds, 638 million yuan of short-term loans, and 311.In

the Prospectus, Meijing New Material also indicates the risk that if the company fails to continuously and effectively improve the cash inflow from operating activities or effectively broaden the financing channels in the future, or if the external operating environment has a significant adverse impact on its performance, there may be a significant risk of debt repayment, which will adversely affect the company's sustainable operation ability.

The sprint GEM IPO, Meijing New Material intends to raise 1.5 billion yuan, 415 million yuan of the amount raised is expected to be used to supplement liquidity, the remaining 10.

At the same time, the parent company Jingsheng Mechatronics also extended a helping hand to Meijing New Material, providing hundreds of millions of yuan of loans. From 2020 to 2022, Meijing New Material borrowed 45.5 million yuan and 178 million yuan from its parent company. 1. Jingsheng Mechatronics also provided guarantee for Meijing New Material in bank credit, with a maximum guarantee amount of 300 million yuan. The guarantee starts on December 29, 2021 and ends on December 28, 2022.

The stock price fell by about 49.

is a 78-year-old Zhejiang female

tycoon." Jingsheng Mechatronics directly holds Meijing New Material 57. Cao Jianwei and Qiu Minxiu are the co-actual controllers of Meijing New Material, and they and their concerted actors control the company 62.

Behind Jingsheng Mechatronics and Meijing New Material, there is a story of a retired teacher of Zhejiang University who went into business, realized the leap from academia to business, and eventually became the female head of GEM.

In 1945, Qiu Minxiu was born in Hangzhou, Zhejiang Province. In 1962, Qiu Minxiu, who was only 17 years old, studied in the Mechanical Department of Zhejiang University. After graduation, he was assigned to Linan General Machinery Factory in Zhejiang Province and worked as a technician for eight years.

In 1977, Qiu Minxiu, 32, returned to his alma mater, Zhejiang University, and worked in the Hydraulic Teaching and Research Department, the Institute of Fluid Transmission and Control, and the Institute of Mechanical and Electronic Control Engineering, successively serving as laboratory director, researcher, and deputy director of the Institute of Mechanical and Electrical Engineering. In 1999, he was appointed Secretary of the Party Committee of the School of Mechanical and Energy Engineering of Zhejiang University until his retirement in 2005.

During this period, Qiu Minxiu's academic achievements were fruitful. She has undertaken and participated in more than 30 NSFC projects, 863 projects, national major science and technology special projects and provincial and ministerial science and technology projects in the field of electro-hydraulic control technology; her scientific research achievements have won 3 national awards such as the second prize of national invention and the second prize of national science and technology progress, and 4 provincial and ministerial science and technology first prizes. Most

good marriages are evenly matched. During the same period, Qiu Minxiu's husband, Lu Yongxiang, also worked at Zhejiang University. He served as a lecturer, director of the research department, deputy director of the University's Institute of Science and Technology, and director of the Institute of Fluid Transmission and Control. The couple jointly published many articles on fluid mechanics and jointly applied for patent technology. After

1990, her husband Lu Yongxiang was elected academician of the Third World Academy of Sciences, academician of the Chinese Academy of Sciences and academician of the Chinese Academy of Engineering. At the age of 55, he served as president of the Chinese Academy of Sciences. After

retirement, Qiu Minxiu did not choose to live in retirement. In 2006, the second year of retirement, Qiu Minxiu, 61 years old, began to start his own business. In December

2006, Jingsheng Mechatronics was established. The company's main business products are crystal growth and processing equipment used in the upstream of photovoltaic and semiconductor integrated circuit industries. At the same time, it extends the layout of sapphire materials, silicon carbide materials and auxiliary materials and consumables at the core of related industrial chains, such as quartz crucibles, diamond wires, precision parts and other fields.

Six years later, Qiu Minxiu harvested her first listed company, and in May 2012, Jingsheng Mechatronics was successfully listed. But four years later, in 2016, Qiu Minxiu, 71, stepped down as chairman of Jingsheng Mechatronics and handed the baton to his student Cao Jianwei.

At that time, Qiu Minxiu's son, He Jun, also served as director and president of Jingsheng Mechatronics, while his daughter, He Jie, acted in concert with the company, but did not hold any position.

Cao Jianwei was also born in technology, with a doctorate in engineering, and has won many provincial science and technology awards in Zhejiang Province. After he took over Jingsheng Mechatronics, he really didn't let Qiu Minxiu down.

In 2016, the revenue of Jingsheng was about 1.09 billion and the net profit was about 204 million; in 2022, the company's revenue exceeded 10 billion and reached 10.638 billion yuan, an increase of 78.45% over the previous year, and the net profit was 2.924 billion yuan, an increase of 70% over the previous year. The revenue increased nearly 10 times and the profit increased more than 14 times. Qiu Minxiu, who

retreated behind the scenes, did not disappear in the eyes of the public. In 2022, at the age of 77, she ranked 309 on the Hurun Rich List 2022 with a net worth of 18.5 billion yuan, becoming a rich woman in the photovoltaic circle.

浙公网安备33010802003254号

浙公网安备33010802003254号