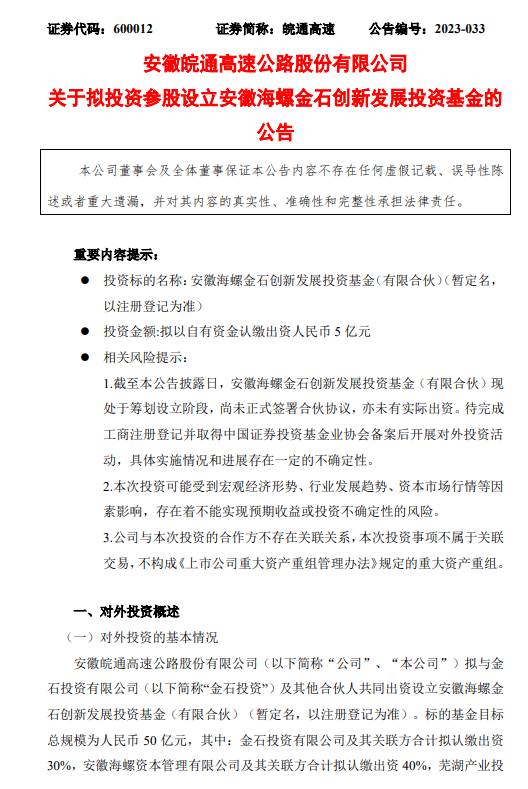

Recently, Wantong Expressway (600012. SH) announced that the company intends to co-invest with Jinshi Investment Co., Ltd. (Hereinafter referred to as "Jinshi Investment") and other partners to establish Anhui Conch Jinshi Innovation and Development Investment Fund (Limited Partnership) (tentative name, subject to registration). The total target size of

the underlying fund is RMB5 billion, of which 30% is proposed to be subscribed by Jinshi Investment Co., Ltd. and its related parties, 40% is proposed to be subscribed by Anhui Conch Capital Management Co., Ltd. and its related parties, and 20% is proposed to be subscribed by Wuhu Industrial Investment Fund Co., Ltd. It intends to subscribe RMB 500 million with its own capital, accounting for 10% of the capital contribution of the partnership. Jinshi Investment acts as general partner, executive partner and fund manager, and CITIC Private Equity Fund Management Co., Ltd. (Hereinafter referred to as "CITIC Private Equity") acts as general partner.

The target fund focuses on strategic emerging industries and high-tech industries such as new energy, new materials, carbon technology, digital industry, green environmental protection and intelligent transportation. Based on the strategic cooperation platform of the fund, the company can explore business opportunities in strategic emerging industries such as intelligent transportation, new materials and new energy, improve the efficiency of capital use and further enhance the company's comprehensive profitability.

It is noteworthy that Anhui Conch Capital Management Co., Ltd. (Hereinafter referred to as "Conch Capital") has appeared in the list of shareholders, with a subscribed capital contribution of 2 billion yuan. This is the "same door" of Conch Cement , which is 95% owned by Conch Group, the controlling shareholder of Conch Cement, and 5% owned by Conch Kechuang, a wholly-owned subsidiary of Conch Group, with a planned capital contribution of 500 million yuan.

浙公网安备33010802003254号

浙公网安备33010802003254号