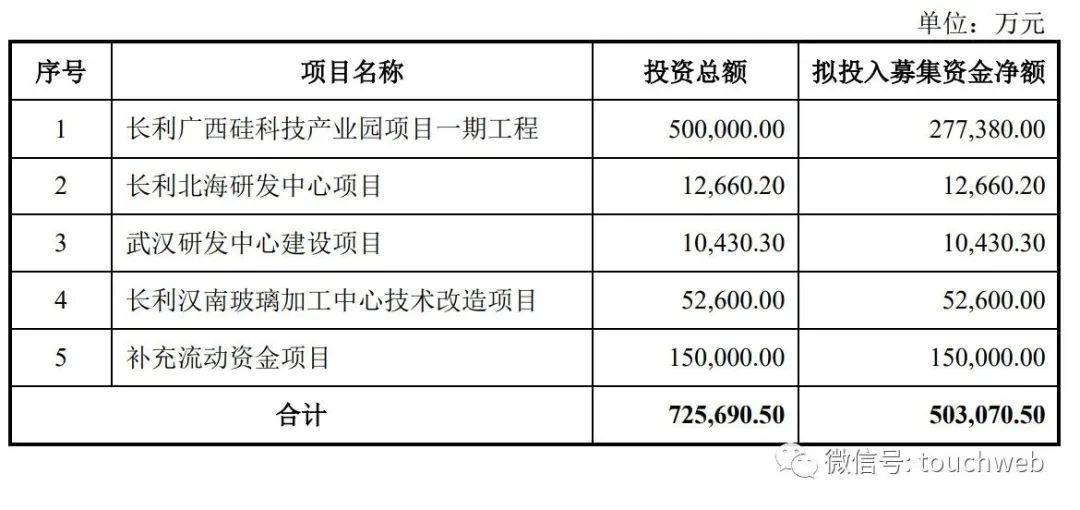

Wuhan Changli New Material Technology Co., Ltd. (Hereinafter referred to as "Changli New Material") recently pre-disclosed its prospectus and prepared to be listed on the Shanghai Stock Exchange. Changli New Material plans to raise 5.03 billion yuan.

Among them, 2.774 billion yuan was used for the first phase of Changli Guangxi Silicon Science and Technology Industrial Park Project, 127 million yuan for Changli Beihai R & D Center Project, 104 million yuan for Wuhan R & D Center Construction Project, 526 million yuan for Changli Hannan Glass Processing Center Technical Renovation Project and 1.5 billion yuan for supplementary liquidity project. Changli New Material, with

an annual revenue of 3.4 billion yuan

, is engaged in the research and development, production and sales of glass products, including float glass, coated glass, photovoltaic glass and other deep-processed glass , and is one of the top ten manufacturers of float glass in China. The largest Low-E coated glass manufacturer in central China.

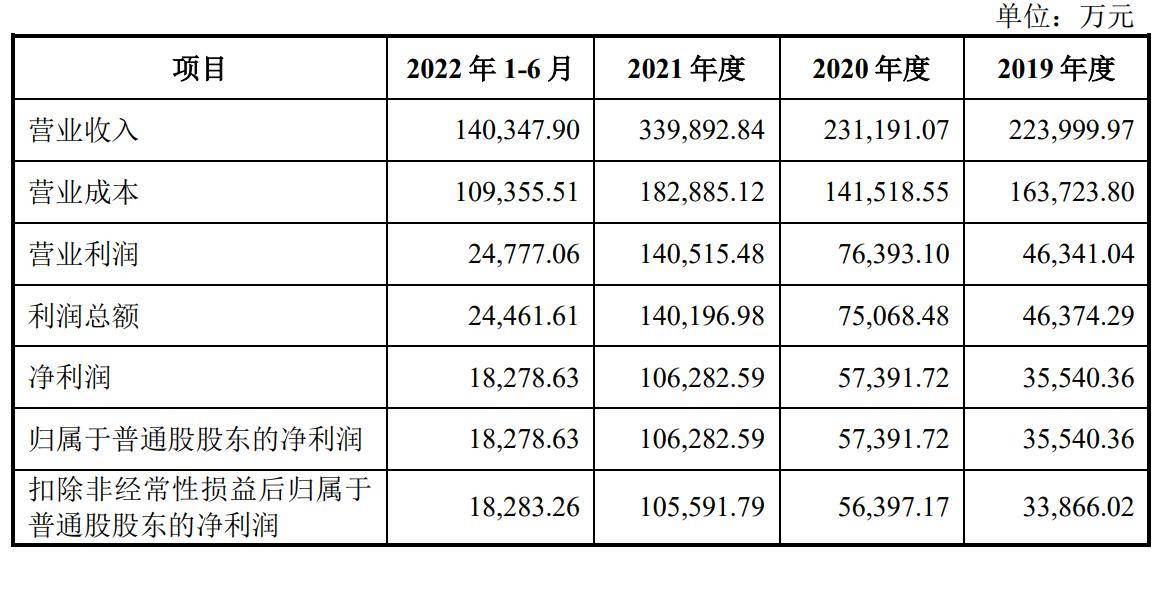

The prospectus shows that the revenue of Changli New Material in 2019, 2020 and 2021 is 2.24 billion yuan, 2.312 billion yuan and 3.399 billion yuan respectively, and the net profit is 355 million yuan, 574 million yuan and 1.063 billion yuan respectively; Net profits after deduction were 339 million yuan, 564 million yuan and 1.056 billion yuan respectively. In the first half of 2022, the revenue

of Changli New Material was 1.4 billion yuan, the net profit was 183 million yuan, and the net profit after deduction was 183 million yuan.

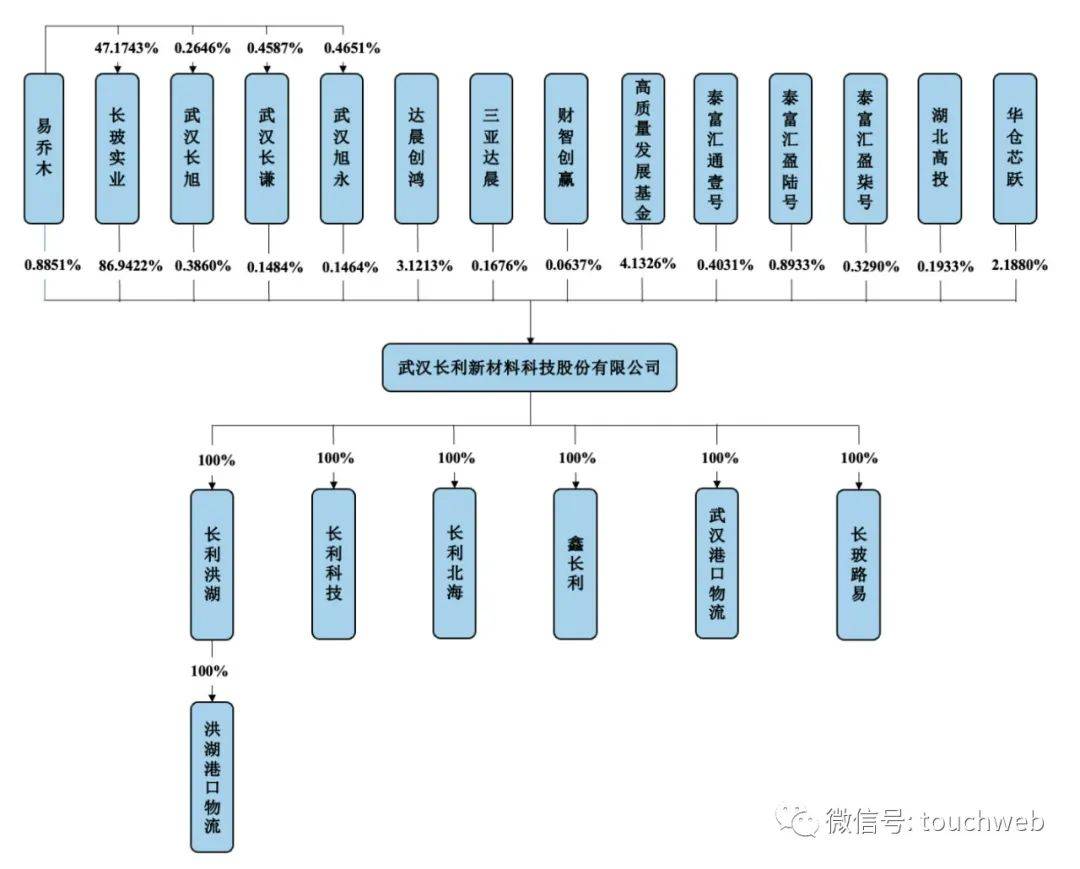

Yi Qiaomu controls 87% of the shares

of Changli New Material. The controlling shareholder of Changli New Material is Changbo Industrial. As of the signing date of this prospectus, Changbo Industrial directly holds 206,284,615 shares of the Company, accounting for 86.9422% of the total share capital of the Company before issuance. The actual controller of the

Company is Yi Qiaomu. As of the signing date of this prospectus, Yi Qiaomu directly holds 2.1 million shares of the Company and indirectly holds 97,313,299 shares of the Company through Changbo Industry. Through the three shareholding platforms of Wuhan Changxu, Wuhan Changqian and Wuhan Xuyong, the company indirectly holds 5.654 million shares, accounting for 41.9018% of the company's total equity before issuance. Before the

IPO, the high-quality development fund held 4.1326%, Dachen Chuanghong held 3.1213%, Huacang Xinyue held 2.188%, Taifu Huiyinglu held 0.8933%, Yiqiaomu held 0.8851%, Taifu Huitong No.1 held 0.4031%. Wuhan Changxu holds 0.386%, Taifu Huiying No.7 holds 0.329%, Hubei Gaotou holds 0.1933%, Sanya Dachen holds 0.1676%, Wuhan Changqian holds 0.1484%, Wuhan Xuyong holds 0.1464%, and Caizhi Chuangying holds 0.0637%. After the

IPO, Changbo Industrial Holdings were 65.2044%, High-quality Development Fund Holdings were 3.0993%, Dachen Chuanghong Holdings were 2.3409%, Huacang Xinyue Holdings were 1.641%, Taifuhui Yinglu Holdings were 0.67%, and Yiqiaomu Holdings were 0.6638%. Taifu Huitong No.1 holds 0.3023% shares;

Wuhan Changxu holds 0.2895%, Taifu Huiying No.7 holds 0.2468%, Hubei Gaotou holds 0.145%, Sanya Dachen holds 0.1257%, Wuhan Changqian holds 0.1113%, Wuhan Xuyong holds 0.1098%, and Caizhi Chuangying holds 0.0478%.

浙公网安备33010802003254号

浙公网安备33010802003254号