Recently, a number of agencies announced the sales situation of the top 100 housing enterprises from January to April 2023. Kerui report shows that in March, TOP100 real estate enterprises achieved a sales amount of 566.54 billion yuan, with a monthly performance of 14.4% lower than previous month, an increase of 31.6% over the previous year, and a further increase over the previous month. In terms of cumulative performance, from January to April, the top 100 real estate enterprises achieved a sales volume of 20499 220 million yuan, and the cumulative performance increased further to 9.7% since the first quarter.

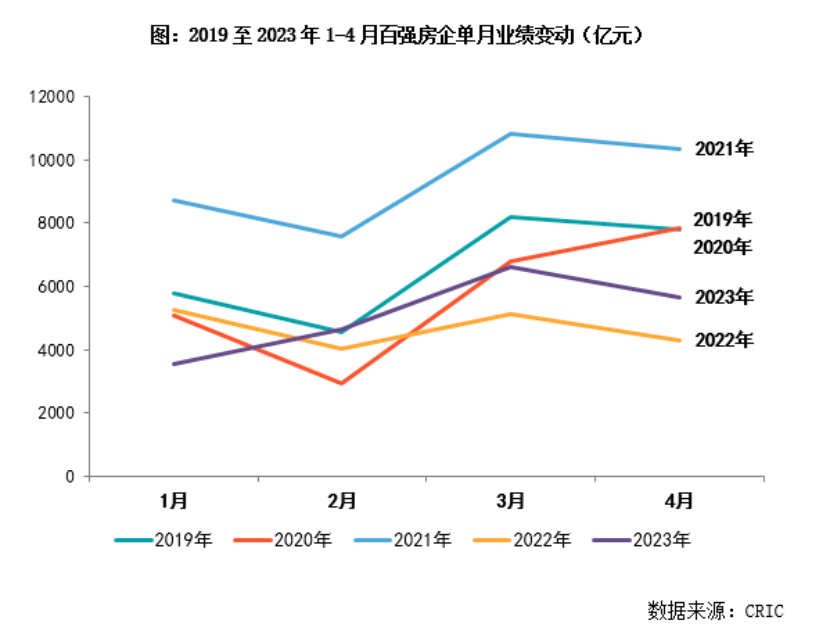

Industry insiders pointed out that although the real estate market has stopped falling and rebounded since 2023, industry confidence has not yet been fully restored, and the overall purchasing power of the market is still at a relatively low historical level.

According to the data of Zhongzhi Research Institute, the total sales of TOP100 real estate enterprises in January-April were 23934 600 million yuan, an increase of 12.8% over the same period last year, and continued to grow. Among them, the monthly sales of TOP100 housing enterprises in April fell by 17.4%, up 29.9% year-on-year. Sales exceeded 100 billion housing enterprises 6, an increase of 3 over the same period last year, 10 billion housing enterprises 59, an increase of 2 over the same period last year. The equity sales volume of TOP100 real estate enterprises is 1.08 billion yuan 16614, and the equity sales area is 96.111 million square meters.

In response, Liu Shui, director of enterprise research at the China Research Institute, said that after the centralized release of the backlog of demand in the early stage, the current market activity in some key cities has declined, resulting in a decline in the ring-to-ring ratio.

At the same time, from January to April, there were 6 real estate enterprises in the camp of more than 100 billion yuan, an increase of 3 over the same period last year, with an average sales of 124.33 billion yuan. The second camp (50-100 billion) has 8 enterprises, an increase of 2 over the same period last year, with an average sales of 63.64 billion yuan. The third camp (30-50 billion) has 3 enterprises, 4 fewer than same period last year, with an average sales of 39.02 billion yuan. The fourth camp (10-30 billion) has 42 enterprises, an increase of 1 over the same period last year, with an average sales of 17.67 billion yuan.

In addition, from January to April, the sales of housing enterprises in all camps increased. Among them, the average sales of TOP10 real estate enterprises was 102.31 billion yuan, an increase of 17.1% over the previous year; the average sales of TOP11-30 real estate enterprises was 33.78 billion yuan, an increase of 18.5% over the previous year, the fastest growth; the average sales of TOP31-50 real estate enterprises was 15.58 billion yuan, a decrease of 0.6% over the previous year; The average sales volume of TOP51-100 real estate enterprises was 7.66 billion yuan, an increase of 4.8% over the same period last year.

On the whole, Liu Shui believes that housing enterprises in all camps should seize the opportunity of favorable policies and rising expectations of house purchases, accelerate the push, increase marketing efforts, and increase sales to a certain extent.

According to the statistics of Zhongzhi Research Institute, Poly Development ranked first with sales of 155.6 billion yuan, Vanke ranked second with sales of 133.38 billion yuan, and Zhonghai Real Estate ranked third with sales of 117.9 billion yuan. In this regard, Liu Shui mentioned that the sales growth rate of head housing enterprises is faster, while the growth rate of small and medium-sized housing enterprises is slower.

From the perspective of monthly performance, the Kerui report shows that China Merchants Shekou, Binjiang Group, China Railway Construction Corporation and other enterprises have achieved month-on-month growth in monthly performance, and the enterprises with month-on-month growth in April accounted for nearly 30% of the top 100 real estate enterprises; at the same time, nearly 60% of the top 100 real estate enterprises have achieved year-on-year growth in monthly performance. In terms of echelons, the number of enterprises whose monthly performance of TOP10 echelon housing enterprises increased year-on-year accounted for the highest proportion. Among them, the monthly performance of Huarun Land, Merchants Shekou, Greentown China, Jianfa Real Estate and other housing enterprises in April increased by more than 100% year-on-year.

In addition, the Kerui report also mentioned that the performance of Binjiang Group, China Railway Construction, Poly Real Estate, International Trade Real Estate and other enterprises in April was relatively outstanding. Generally speaking, the central state-owned enterprises and some high-quality private enterprises show strong anti-cyclical resilience by virtue of the layout of hot cities and the positive push.

(Source: Kerui Research Center, CCTV)

According to the market data, according to the preliminary statistics of Zhongzhi Research Institute, the transaction area of new houses in 100 key cities decreased by about 20% on a month-on-month basis, and still increased by more than 40% on a year-on-year basis under the low base of the same period last year. From January to April, the average monthly sales area of commercial residential buildings in 100 key cities increased by more than 20% year-on-year, but the absolute scale is still at a low level in the same period since 2015. From the supply side, in April, the pace of enterprise push slowed down, according to the index data, the key 50 cities approved listing area fell by about 30%.

Overall, Liu Shui said that after the centralized release of the backlog of demand in the early stage, the current market activity in key cities has declined, and some urban markets have cooled down significantly. Under the weak income and employment expectations of residents, the momentum for further recovery of the market is insufficient, and the short-term real estate policy will remain loose, so it is essential to stabilize the confidence and expectations of home buyers. With the further optimization and adjustment of local policies and the steady recovery of macro-economy, the national real estate market is expected to stabilize in the second quarter, but the differentiation between cities continues, and the market activity of hot cities is expected to maintain, but most cities are still facing greater adjustment pressure.

浙公网安备33010802003254号

浙公网安备33010802003254号