In July, after two consecutive months of sideways trading, soda ash rebounded strongly, with the 09 contract rising by about 23%. The main reason for this round of market rise is the unexpected disturbance of the plant, the production of yuanxing Energy is less than expected, the supply of soda ash is tight, and the spot price is rising. However, due to the pessimistic expectation of soda ash oversupply in the early stage, the downstream stock willingness is poor and the inventory is actively compressed, so the downstream and social inventory of soda ash are at a low level. Originally, the market expected that the output of yuanxing Energy could partially compensate for the loss of supply caused by maintenance, and the market would not be out of stock, even in September, there was an expectation of excess supply. But in fact, the inventory of alkali plants continued to decline, some areas were short of goods, and spot prices rose, which led to the upward repair of the larger basis. The main reasons

for the recent sharp rise in

soda ash 1. Unexpected disturbance

of the plant Before July this year, the operating rate of soda ash has been maintained at more than 90%, and the supply reduction caused by plant failure and maintenance is very small, far less than in previous years. The main reason is that after yuanxing Energy is put into operation on schedule, the price reduction is expected to be larger, so the alkali plant has been maintaining a high operating rate to maximize benefits, and even for the traditional summer maintenance season, the market also has the expectation of delayed maintenance.

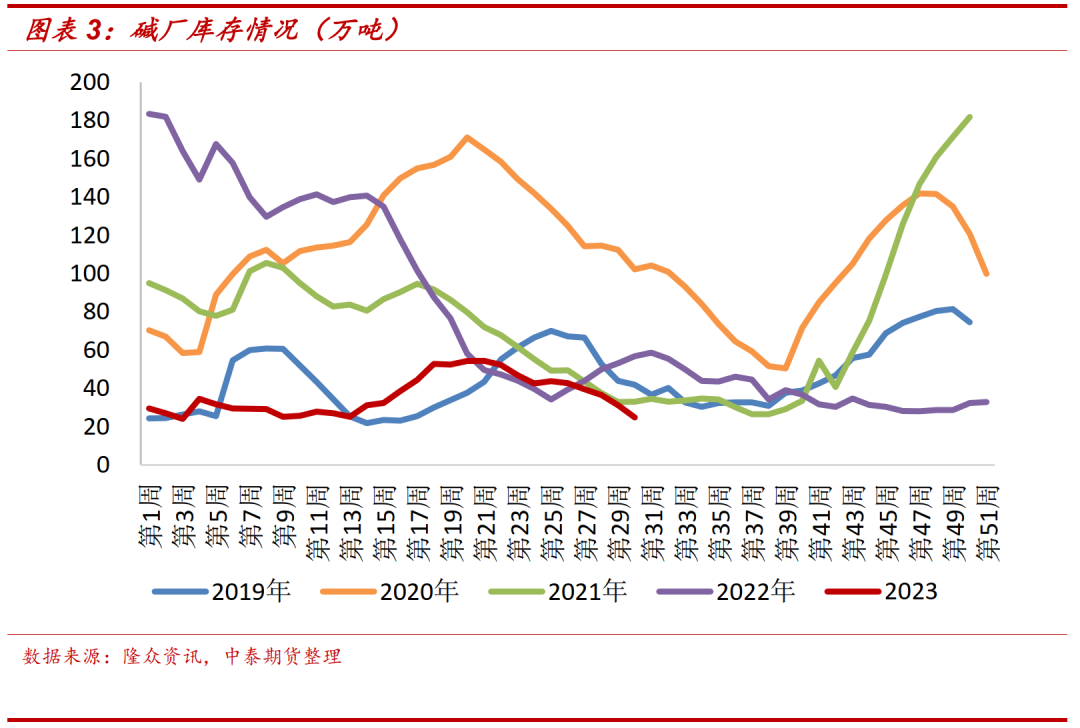

With the expectation of loose supply after the early trading of yuanxing in the market, the current price of soda ash has fallen sharply, and the inventory of all links in the soda ash industry chain has been continuously compressed, resulting in the overall inventory of soda ash at a historically low level. When the summer maintenance season came as scheduled, the operating rate of soda ash began to decline, although the range was not large, but because the release of yuanxing energy production was less than expected, the inventory of alkali plants continued to decline, the spot began to be tight, and the willingness of alkali plants to raise prices increased. Since last week, alkali plants with large production capacity, such as Qinghai Kunlun and Development Investment, have begun to reduce their burden due to environmental protection problems. The duration of the reduction is to be determined. The operating rate of soda ash has fallen rapidly to a low level of 81.59%. Some alkali plants have not quoted prices. The spot price has become increasingly tense and the price has risen, which has led to the upward repair of the basis difference in the near month contract and the repair of the over-pessimistic expectation in the far month contract.

2. The output release of yuanxing Energy was less than expected

, and the decline of soda ash by more than 50% in April-May was mainly brought about by the expected production of yuanxing Energy. With the successful ignition of No.1 boiler in the early morning of May 20, the market's expectation of future supply easing became more and more certain, and the market showed a deep discount spot. In the far month, it dropped to around the cost price of 1370 yuan/ton. Market concerns about supply losses caused by summer plant maintenance have also weakened, and the 09 disk has remained low and volatile. However, yuanxing Line 1 is full of twists and turns from the feeding after ignition to the production of products, during which the market "small composition" continues, from water indicators to product crystallization problems, hydration device problems and so on, causing the market to worry about the balance of supply and demand of soda ash in August and September. Up to now, the first line of yuanxing Energy is still dominated by light alkali, and the output is low. The ignition time of the second line has been delayed. The output release of yuanxing Energy in July is far less than market expectation, which can not make up for the loss caused by the summer overhaul, and the market has also raised greater doubts about the follow-up full production time, and the contract price of the far month has been repaired. yuanxing Energy has driven two waves of soda ash market, and the focus of the future soda ash price trend is still on the production rhythm of yuanxing Energy.

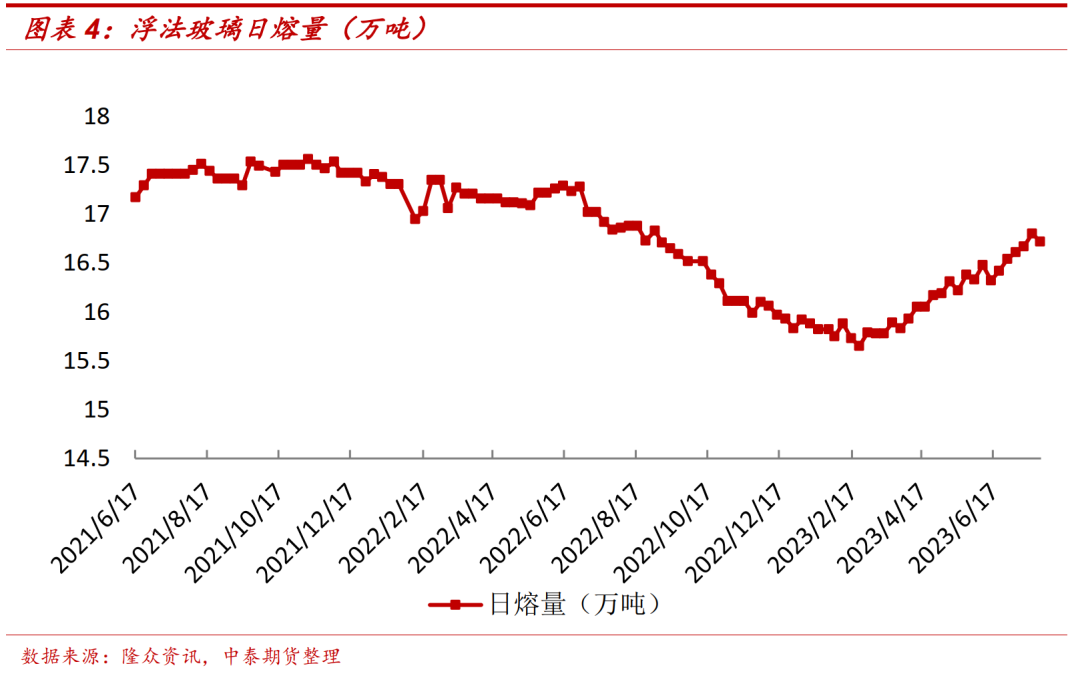

Supply decreased and demand increased, and the soda ash spot was tight

. Last week, the soda ash plant continued to remove 64,700 tons from the warehouse, and the current inventory dropped to 248,300 tons, including 122,100 tons of light alkali inventory, 126,200 tons of heavy alkali inventory, and about 20,000 tons of social inventory, which dropped to about 120,000 tons. This week, the output of soda ash in two alkali plants in Qinghai dropped to a low of 547200 tons due to unexpected environmental burden reduction, and the output of heavy alkali was 300200 tons, which was 50100 tons less than highest output of 350300 tons in the year. On the demand side, float glass has been put into production recently, with a daily melting capacity of 168000 tons, corresponding to a weekly demand for heavy alkali of 235200 tons, while photovoltaic glass has not changed much in the near future, with a daily melting capacity of about 93100 tons. The corresponding weekly demand for heavy alkali is 117,300 tons. Without considering the demand for heavy alkali in import and export and other fields, the supply of heavy alkali is in short supply at present, corresponding to the supply gap of 50,000-70,000 tons. In the

short term, there is limited room to increase the operating rate of soda ash. Although some soda ash plants have resumed production after overhaul, there are still other soda ash plants planned to be overhauled, such as Zhongyan Kunshan and Anhui Debang. In addition, Qinghai Kunlun and Qinghai Fatou Alkali Industry will continue to reduce the negative time, and the operating rate is expected to remain low. The possibility that the output of yuanxing Energy will be released in a large amount in the short term is also relatively low. The output of Line 1 is limited, the ignition time of Line 2 is to be determined, and the production time will continue to be delayed. Therefore, the short-term spot soda ash is still in a tight state, the inventory of soda ash plants continues to decline, and the spot price is expected to rise further.

Supply expectations are still uncertain

, and the focus of market attention is still on the production progress of yuanxing Energy. On the one hand, due to the current tight spot, if the production of yuanxing Energy continues to maintain low production, the supply loss caused by the maintenance season will further reduce the inventory of alkali plants, resulting in a serious shortage of spot, which will drive the spot price up synchronously. On the other hand, if the follow-up of yuanxing Energy is gradually released and the products are produced smoothly after the ignition of Line 2, the market is expected to reverse again. Although the short-term improvement of spot tightening is limited, the panic of the gradual easing of follow-up supply will be reflected in the futures ahead of time, and the market will face a new round of downward risk.

At present, there is little probability that the soda ash 2309 contract will continue to rise after repairing the basis difference, and the follow-up will keep rising and falling with the spot. It is relatively appropriate to pay attention to the soda ash 2310 contract and the short-selling opportunities of the follow-up contract. The main reason is that after October, the traditional maintenance season is coming to an end, the probability of industry limiting production and power is relatively small, the operating rate of soda ash will be significantly improved, and the supply gap will be narrowed. Secondly, October is still two months away from the present, and the commissioning time for yuanxing energy equipment is relatively long, and the probability of capacity release is relatively high. Last week, the soda 2310 contract rose for two consecutive days, and the spot basis was significantly reduced, so we can consider the high layout of the soda 2310 and subsequent contracts.

To sum up

, the decline of soda ash by more than 50% in April and May, as well as the two waves of market rising at the bottom of July, are all disturbed by the supply side, among which the production progress of yuanxing Energy plays a vital role, which is directly related to the tension of spot. Recently, the market is interwoven with bullish and bearish news, and the contracts in recent months have been disturbed by market news, and the volatility has increased significantly. At present, the tight spot is a fact, but whether the tight spot can be sustained is still very uncertain. The duration of production restriction and negative reduction of Qinghai Kunlun and Fatou Alkali Industry and the time of stable volume of yuanxing Energy Plant have a greater impact on the trend of soda ash contracts in recent months. It is suggested that the contracts in recent months should be wait-and-see. After October, the disturbance of plant maintenance to supply is reduced, the probability of stable volume of yuanxing Energy is increased, and the trend of far-month contracts is still dominated by bias. It can be considered that the soda 2310 and subsequent contracts are empty in the high layout.

Risk warning: other factors disturb the supply; the production of yuanxing Energy Line 2 continues to be delayed

.

浙公网安备33010802003254号

浙公网安备33010802003254号