, we have combed the internal logical relationship between real estate and glass.".

General real estate needs funds to carry out a series of development investments, of which the main sources of funds are domestic loans, self-financing, deposits and advance receipts, and personal mortgages, while deposits and advance receipts, personal mortgages mainly come from real estate sales. After the

real estate gets the funds, it will make a series of development investments, first purchasing land, starting new construction, and then completing the house. Before 2016, the proportion of forward sales was relatively stable, basically around 75%. From 2016 to 2021, the proportion of forward sales increased continuously, reaching 89% at the highest time. With the continuous thunderstorm of real estate, the proportion of forward sales dropped sharply, but it is still the mainstream sales mode at present.

The so-called auction sales, is a new start for a period of time, get the pre-sale permit, pre-sale, and then the completion of the construction delivery, and Xianfang sales refers to the completion of sales.

The glass installation time is before the completion, so the completion data can reflect the demand for glass to a certain extent. At the same time, real estate sales have an important impact on the demand for glass. On the one hand, real estate sales determine the source of funds, which will affect the rhythm of a series of new real estate construction, construction and completion. On the other hand, the demand for delivery after the sale of forward delivery houses will form the demand for glass. Of course, the purchase of land, new construction and construction will affect the completion of the stock.

Figure 1: Logic diagram

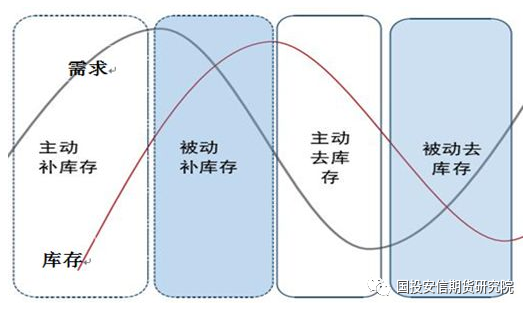

of the relationship between property and glass (1) Passive Inventory Reduction: The continuous reduction of production and inventory has changed the supply and demand pattern of the market." Commodity prices began to stabilize and reverse. Although production and sales are on the rise, sales are rising faster, forming a consumption of inventory. At this point, the inventory is passively reduced and the market begins to boom-the economy enters the replenishment stage.

(2) Active inventory increase: As the inventory level reaches a low point and the price continues to rise, the business strategy of enterprises changes from conservative to active: 1) production and procurement are more active; 2) investment or speculation in inventory is carried out. The economy has entered a typical replenishment stage, and the market sentiment is optimistic.

(3) Passive inventory increase: When the market demand decreases, the sales volume of products decreases, but the output has not been adjusted accordingly. At this time, the inventory will increase. This is the inventory backlog caused by unsalable products, which is a passive inventory increase. At this point, the slowdown in growth is beginning to emerge-the economy has entered the stage of destocking.

(4) Active inventory reduction: The continuous accumulation of inventory will force enterprises to adjust their business strategies, and production and procurement tend to be cautious to reduce production; at the same time, measures will be taken to deal with inventory, either dumping at a lower price or reducing production to ease the pressure of price decline.

Figure 2: Data source of inventory

periodicity: data collation, SDIC Anxin Futures

Chart 3: Inventory Cycle Stage

Figure 4: Inventory Trend

of Glass Manufacturers and Traders

Figure 5: Logic Diagram

of Property Completion and Glass Inventory , but the glass inventory is seasonal, the Spring Festival is the low season of the year, and the downstream demand is stagnant." The output is directly converted into inventory, and the accumulation speed is the fastest. We exclude the seasonal factors of the accumulation of the Spring Festival and look at the historical glass inventory cycle changes .

In 2016, the state introduced the real estate stimulus policy, the growth rate of completion increased, the demand for glass increased, the inventory declined, the price rose, and the passive destocking stage.

In 2017, driven by the monetary policy of shanty reform, the real estate industry in the third and fourth lines still showed a good trend, but the real estate model with high turnover and the real estate enterprises were more inclined to invest in the front end of the real estate industry, which resulted in the growth rate of completion less than that of new construction and sales, although it was still in a positive growth, but it declined, and the corresponding glass inventory was still in a low pattern. However, the inventory level has risen relative to the center of gravity in 2016.

In 2018, with the gradual tightening of real estate policy, the slowdown of real estate growth, the acceleration of capital reflux by real estate enterprises, and the further widening of the gap between back-end investment and front-end investment, the growth rate of completion continued to decline, far less than growth rate of sales and new construction, and the corresponding focus of glass inventory further rose.

In 2019, the performance of real estate is better than expected, the marginal recovery of the first and second lines, coupled with the need for delivery, the growth rate of completion has warmed up, the scissors gap with new construction and sales has narrowed, and glass has also entered the passive destocking stage brought about by the improvement of demand. At the beginning of

2020, due to the epidemic situation in Wuhan, the demand stagnated and the glass accumulated rapidly. Later, as the impact of the epidemic weakened, the demand was released centrally, coupled with the phenomenon of rush work, the completion maintained a high growth rate, and the glass entered the stage of destocking. In the first half of

2021, the resilience of real estate demand remained, coupled with the need to guarantee the delivery of housing, the completion maintained a high growth rate, and the glass was also in a low inventory state. Beginning in the second half of the year, with the continuous thunderstorms in real estate, despite the need to guarantee the delivery of housing, the capital turnover of housing enterprises is poor, the completion is greatly discounted, the growth rate is declining rapidly, and the glass has entered a passive accumulation stage. At the beginning of

2023, the completion showed a trend of recovery, and the glass also saw some signs of going to the warehouse. Can this pattern be sustained? The smooth operation of guaranteed delivery is crucial to the demand for glass. Before 2016, the transmission from new construction to completion is about 1. By comparison, it is found that after 2016, the year-on-year growth rate of new construction in the same month is three years later and the year-on-year growth rate of completed area in the same month is more synergistic, but in 2022, due to financial pressure, the growth rate of completion is not as good as expected, and there are some demands for guaranteed delivery in 2022 that are pushed to 2023. Therefore, there is still a stock of 2023 completion, but the key factor to control the pace of completion is still real estate funds, and the core of real estate funds is sales. From the comparison of sales growth rate and completion growth rate, the correlation between the two is stronger, which is also the main reason why the completion performance of 2022 is much lower than expected. This year's glass inventory trend, on the one hand, depends on the demand for the completion of the stock, on the other hand, depends on the implementation of the policy of guaranteeing the delivery of houses and the recovery of real estate sales.

">

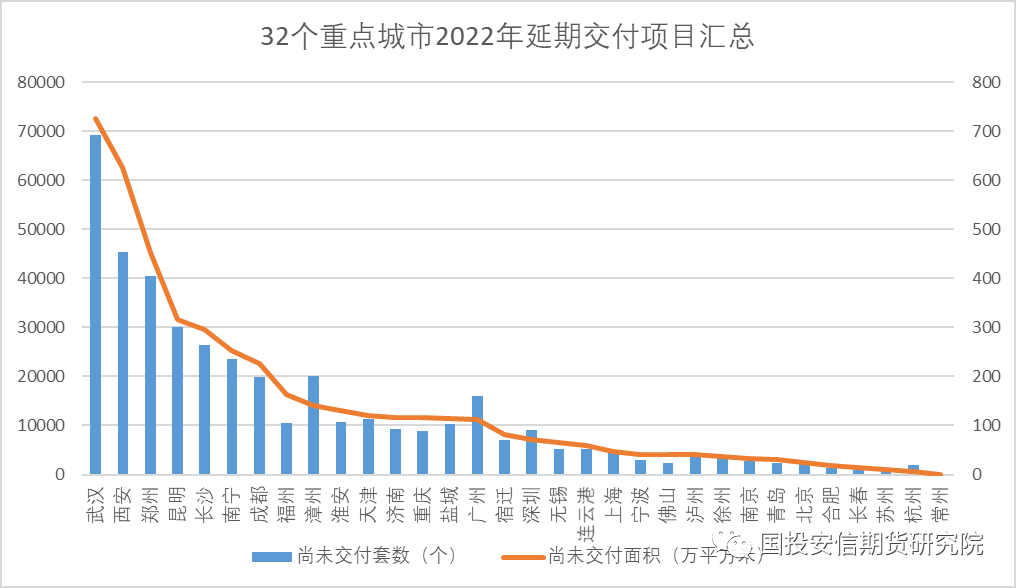

2023 is expected to usher in a wave of delivery.

by the end of 2022, According to the statistics, 62 projects were fully resumed, 86 projects were partially resumed, 16 projects were intermittently and small-scale resumed, and 126 projects continued to be suspended. More than half of them have resumed work, which is expected to form the completion demand in 2023, but there are still a large number of projects that continue to be shut down, depending on the strength of the state's housing guarantee and the financial situation of housing enterprises, whether this part can be converted to the completion demand in 2023 remains to be verified.

Figure 8: Summary

of delayed delivery projects in 32 key cities Source: Kerui, SDIC Anxin Futures

Chart 9: Resumption

of Suspended Projects in 32 Key Cities

this year's two sessions, the relevant policies on real estate mainly reflect two aspects, one is to effectively prevent and resolve the risks of high-quality head housing enterprises, improve the situation of assets and liabilities, prevent disorderly expansion, and promote the steady development of the real estate industry; In addition, we should strengthen the construction of housing security system, support rigid and improved housing demand, and solve the housing problems of new citizens and young people. Risk prevention is the first priority, which is consistent with the previous central tone. The support for high-quality housing enterprises is expected to continue to increase, and the financial problems of housing enterprises are expected to be improved. It is expected that the delivery of buildings is still the primary task of risk prevention to ensure the smooth operation of the supply side. At the same time, in view of the demand side, supporting rigid and improving demand, the demand-side "precise policy" is expected to continue to be implemented.

Last year's delayed delivery project was postponed to 2023, coupled with a series of policies at both ends of supply and demand, this year's completion is expected to usher in a rebound.

< IMG SRC = "https://np-newsimg.dfcfw.com/download/D24709226272654385602_w399h714. that with the strengthening of the policy of guaranteeing the delivery of houses, the delayed completion of last year is expected to be postponed to this year." The number of houses that need to be delivered this year has increased significantly compared with last year. Recent real estate sales show signs of recovery, real estate funds are expected to be improved, to promote the smooth implementation of housing security, the formation of good demand for glass, glass in 2023 is expected to usher in the inventory cycle.

浙公网安备33010802003254号

浙公网安备33010802003254号